May 21, 2025

How to Avoid Tax Refund Delays – (2024-25 Guide)

Waiting for your tax refund can feel like a never-ending journey. While the ATO usually processes most returns within two weeks, many Australians still face frustrating tax refund delays yearly. This guide outlines the common causes of delays, shows you how to estimate your tax refund timeline, and provides practical solutions for typical ATO tax refund issues.

Quick Tips to Keep Your Refund on Track

- Lodge early (July–August) – Beat the end-of-year rush.

- Double-check your details – A wrong TFN or bank account number can freeze your refund.

- Keep receipts handy – Especially for work-from-home (WFH) and vehicle claims.

- Track your refund in MyGov – Respond quickly if the ATO asks for more info.

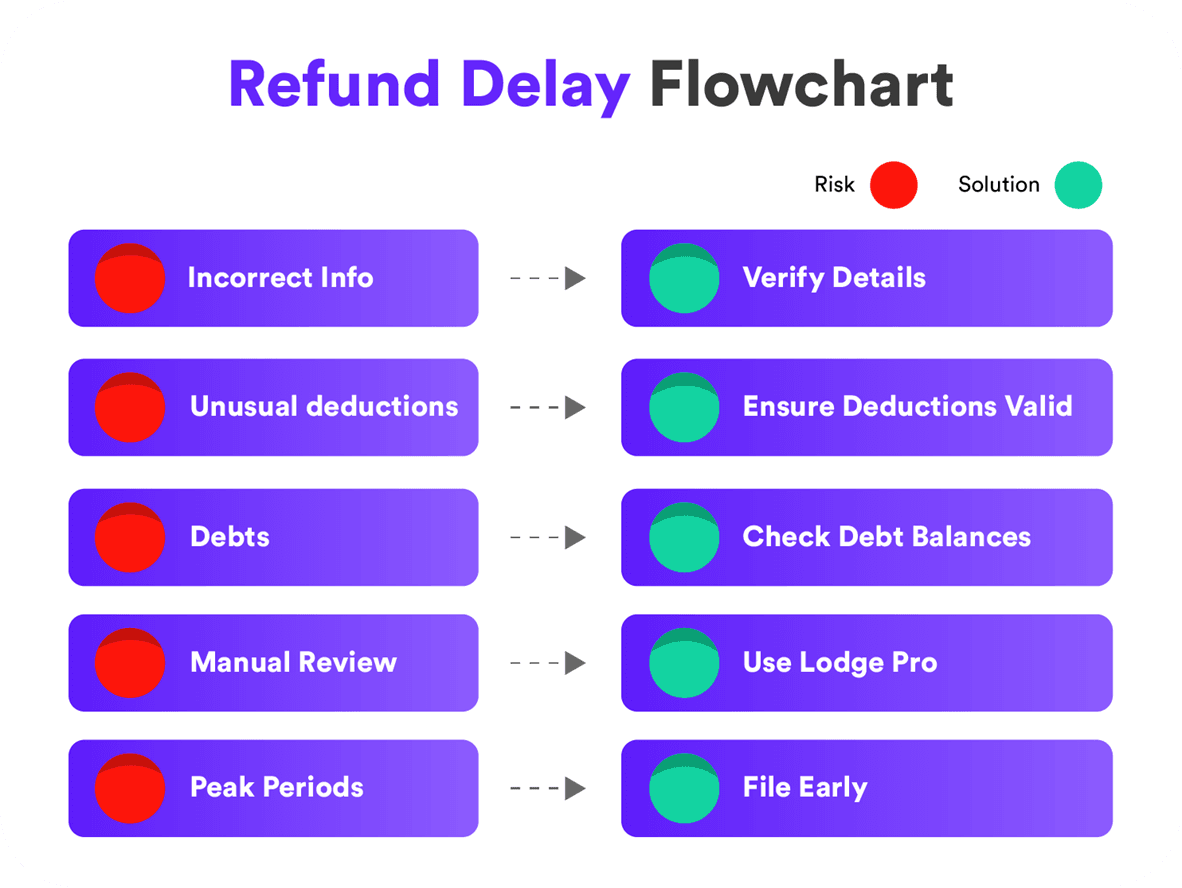

Why ATO Tax Refunds Get Delayed

Incorrect or Missing Information

The Problem:

- Wrong Tax File Number (TFN)

- Missing PAYG summaries or mismatched income

- Incorrect BSB or bank account details

The Fix: Use ATO prefill to match your info, and run Lodge Pro pre-lodgement validation tool to spot issues before you lodge.

Unusual Deductions Claims

The Problem: Claims that are unusually high or inconsistent, such as large vehicle expenses or aggressive work-from-home hours, may be flagged for manual review.

The Fix: Claim only what’s legit and backed by receipts or a 4-week diary. Lodge Pro compares your deductions against ATO averages and flags anything that could hold up your refund.

Outstanding Debts or Offsets

The Problem: Your refund may be reduced or delayed if you owe money to

- ATO (from previous years or PAYG)

- Centrelink

- Child Support

- HELP/HECS

The Fix: Before you lodge, log into MyGov → ATO → Accounts & payments to check any balances.

Manual Processing Triggers

The Problem: These returns are often flagged for review

- First-time lodgers

- Complex returns (e.g. investment properties, crypto, CGT)

- Mismatches between your return and third-party data (banks, employers)

The Fix: If the ATO asks for documents, upload them through MyGov ASAP. Delays happen when you miss these requests.

Peak Lodgement Period

The Problem: Lodging in early July or late September? Expect a queue. The ATO handles millions of returns from July to October.

The Fix: Lodge between mid-July and mid-August or use a registered tax agent to get a later deadline and help avoid ATO tax refund issues.

How to Estimate Your Tax Refund Status

Want a clear idea of where things stand?

Use these tools:

- MyGov → ATO Online Services – real-time updates like “In Progress”, “Balancing”, or “Issued”

- ATO App – same info with handy push notifications

- Phone – Call 13 28 61 with your TFN for help

Want instant insights? Check out our new blog abuut How Much Tax Will I Get Back? or Use Lodge Pro’s free refund calculator to estimate your tax refund before you lodge. Estimate your tax refund now →

Tips to Avoid Tax Refund Delays

Tip | Why it works |

Cross‑check pre‑fill data | Fixes 80 % of TFN and income mismatches. |

Use accurate bank details | Refunds only go to the account you nominate. |

Keep digital receipts | Proves deductions instantly if the ATO asks. |

Lodge during off‑peak dates | Faster automated processing. |

Respond within 14 days | Manual reviews close sooner when docs arrive quickly. |

What to Do If Your Refund Is Delayed

- Wait at least two weeks after lodging (longer for paper submissions).

- Check your MyGov inbox for any ATO messages.

- After four weeks, call the ATO at 13 28 61 with your notice of assessment number.

- Provide any requested documents (ID, invoices, rental statements) within the specified timeframe.

If you’re still concerned, Lodge Pro’s support team can liaise with the ATO on your behalf through our CPA review service.

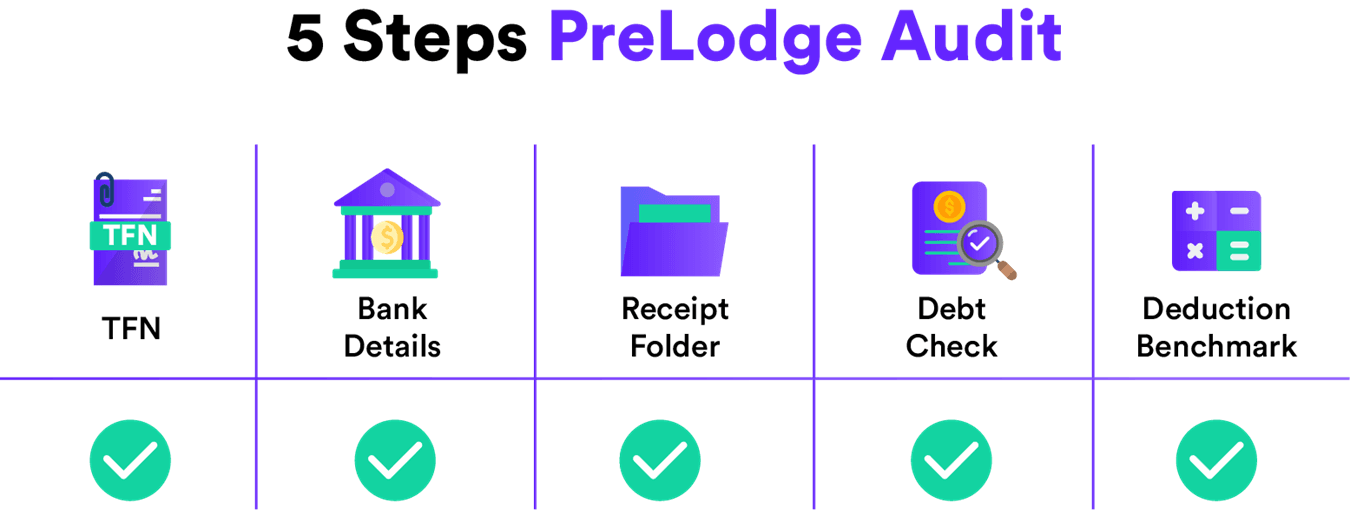

How Lodge Pro Speeds Up Your Refund

Lodge Pro removes the friction points that commonly trigger ATO reviews and payment holds.

How Lodge Pro helps | Benefit to you |

Pre‑lodgement validation – AI checks TFN, BSB/account numbers and pre‑fill mismatches before submission. | Eliminates the most common source of tax refund delays. |

Deduction benchmark engine – compares your claims against real‑time ATO averages. | Reduces the risk of a manual review triggered by unusual deductions. |

Secure Open‑Banking feeds – imports income and expense data automatically. | Minimises data‑entry errors that cause discrepancies. |

Live refund estimator – updates refund amount and projected payment date as you edit deductions. | Gives transparent timing so you can plan cash flow. |

Optional CPA review & ATO liaison – fixed‑fee human review; our CPAs can answer ATO queries on your behalf. | Fast‑tracks resolution of any ATO tax refund issues. |

Common Myths About Tax Refund Delays

Even seasoned taxpayers fall for a few persistent myths that can actually slow down a refund.

Myth | Reality |

"The ATO always pays refunds exactly two weeks after lodgement." | Two weeks is an average for straightforward electronic returns. Complex returns or those lodged during peak periods can take 30 days or more. |

"Large refunds are always audited." | The ATO focuses on risk indicators (mismatched data, unusual deductions), not the size of the refund alone. |

"Using a tax agent guarantees a faster refund." | A registered agent can extend your due date and help you avoid errors, but processing speed still depends on ATO workflows. |

"Amending a lodged return resets the 2‑week clock." | Amendments normally process within 20 business days, separate to the original refund timeline. |

Final Thoughts

Most ATO tax refund issues can be avoided. Lodge accurately, keep thorough records, and don’t leave things to the last minute. Combining these practices with Lodge Pro’s validation checks will help minimise the chance of tax refund delays and inform you when to expect your refund, thanks to our live tax refund estimation tool!