April 28, 2025

How to Use a Simple Tax Calculator to Estimate Your Tax Refund

Let's be honest, tax time can be a massive headache. It’s full of confusing numbers, endless paperwork, and the fear of making mistakes and missing deductions. This can make anyone break into a cold sweat.

But what if we told you that there’s a simple way to estimate your tax refund in minutes? This is where the simple tax calculator comes in, ensuring accurate estimation and zero stress.

Stay with us to learn more about the simple tax calculator. You can be a full-time employee, a freelancer, or a small-business owner. No matter what you are, we will guide you through using a tax calculator the right way. Let’s begin!

What is a Simple Tax Calculator?

A tax calculator is exactly what it sounds like. It is an easy-to-use tool that estimates how much you owe, based on your taxable income. It deals with the numbers on behalf of you, so you don’t have to.

If you have decided to try out a tax calculator to calculate tax online, look out for these factors. Make sure that it updates tax rates automatically, and works for all kinds of income earners like PAYG earners, freelancers, small business owners, etc.

You can find plenty of tax calculators out there. However, out of the ones tailored for Australian taxpayers, the ATO Simple Tax Calculator is a sold choice. The ATO calculator lets you calculate the tax on your taxable income for the 2013-14- and 2023-24-income years.

Your taxable income is what’s left after deducting allowable expenses from your assessable income. Lower taxable income means less tax to pay!

Why Use a Tax Calculator?

You might wonder why use a tax calculator when you could calculate your taxes manually. But the point is, why waste your time and effort when a calculator is faster and more accurate? Let’s explore why using the simple tax calculator is a game-changer.

Firstly, it saves time, and you don’t have to do the confusing math yourself. Secondly, it minimises errors. The ATO tax calculator is always updated with the latest changes in tax laws. Also, it automatically applies the correct tax rates and tax thresholds.

Thirdly, tax calculators help with tax planning, helping you get a clear idea on what to expect in your tax refund. Further, they help you maximise your refund by giving you a clear idea of what your tax refund will be.

Use a Simple Tax Calculator in 5 Simple Steps

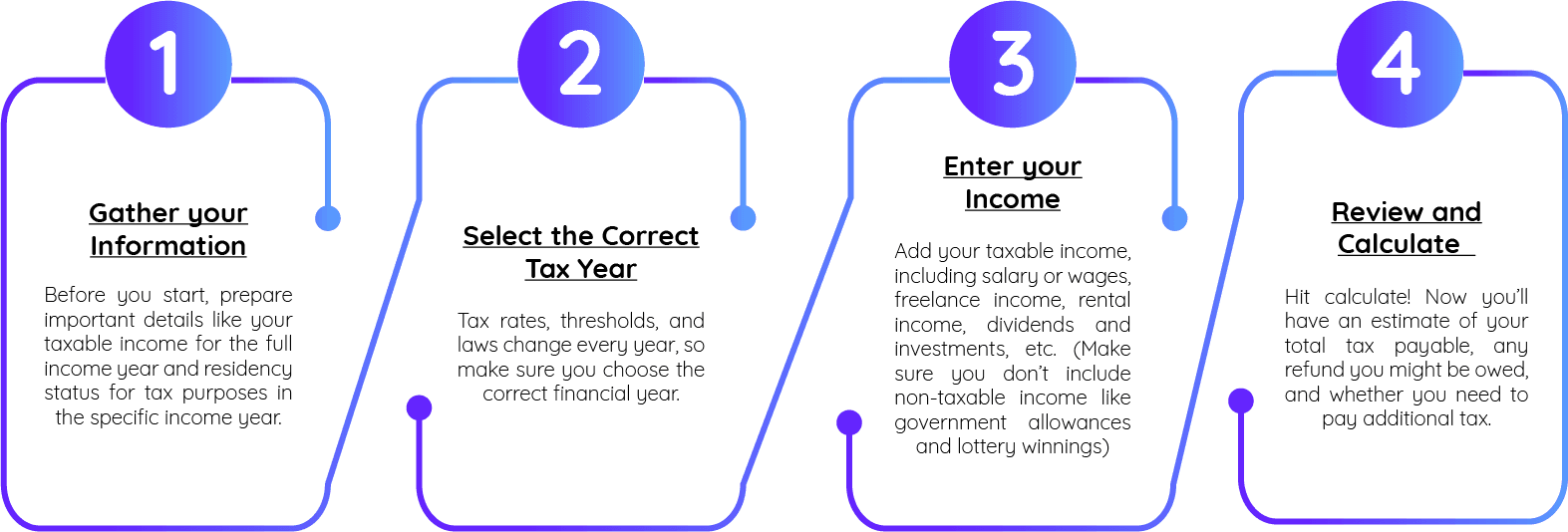

Using a tax calculator to calculate your tax return online isn’t hard at all. The only thing is that you must enter the right details. Here’s how to do it:

Avoiding Common Mistakes

No matter how accurate the tax calculator is, it’s up to you to enter accurate details. So, watch out for these common mistakes.

- Make sure you’re not forgetting any deductions. Remember, whenever you don’t claim a deduction, you’re leaving money on the table!

- Enter all your income sources, double-checking your pay slips and ATO records.

- Tax rates and thresholds change, so make sure you choose the correct financial year.

For the most accurate tax calculation, double-check the details you enter. Simple mistakes that we often overlook, like entering wrong salary amounts, can lead to inaccurate results, costing you money.

At the same time, it’s important to keep accurate records of your work-related expenses. ATO audits can happen anytime, so keep good records to back up your deductions with confidence. Using a reliable tax calculator that stays updated with ATO rules will make your tax calculations even more accurate!

The Bottom Line

One thing to keep in mind is that This calculator only works out tax on your taxable income. It doesn’t include Medicare levy, study loans, FHSS, or working holiday tax. If you want to estimate your tax refund or debt in further detail, you can try the income tax estimator.

Tax time need not be complicated. With a simple tax calculator, you can estimate your tax bill or refund in minutes. They help you save time, reduce errors, and make the best out of your tax refund. So, try using a simple tax calculator and enjoy stress-free tax time.

Subscribe to our weekly newsletter!

Tax breaks in your inbox! Subscribe now.

You can easily unsubscribe from future emails at any time.

Compare us with!