April 30, 2025

HECS Repayment Calculator – Estimate & Plan Your HELP Debt

Many Aussies get the chance to pursue higher studies through the Higher Education Contribution Scheme (HECS-HELP). HECS is a loan program that covers the university tuition fees of eligible students. A part of the loan is usually paid by the government.

HECS-HELP is different from traditional loans as it is income-contingent. This means that you only need to start repaying the loan once your taxable income reaches a specific threshold. This system certainly makes university more accessible.

But it also has its downsides. For example, it burdens graduates with student debt for years. To tackle this, understanding how much you need to repay and planning how you are going to manage your repayments is crucial. This will help you avoid unexpected tax bills.

This is where a HECS repayment calculator becomes an invaluable asset. It helps you estimate your repayments and plan your budget well. Also, it helps you avoid underpayments and strategize ways to pay off your debt faster. Keep reading to learn more about calculating HECS repayment.

Manage Your HECS Debt with Ease

If you have taken out a HECS loan to fund your education in Australia, you’ll have to start repaying once your income reaches the minimum threshold. When calculating how much you have to pay annually, the HECS repayment calculator comes in handy. Using one helps you estimate your repayments, plan your finances, and avoid unexpected deductions from your salary.

As stated above, HECS-HELP is income-contingent. This means you only need to start repaying once you earn above the repayment threshold. The repayment rates depend on your taxable income, and the ATO auto-deducts the payment through the Pay as You Go (PAYG) system.

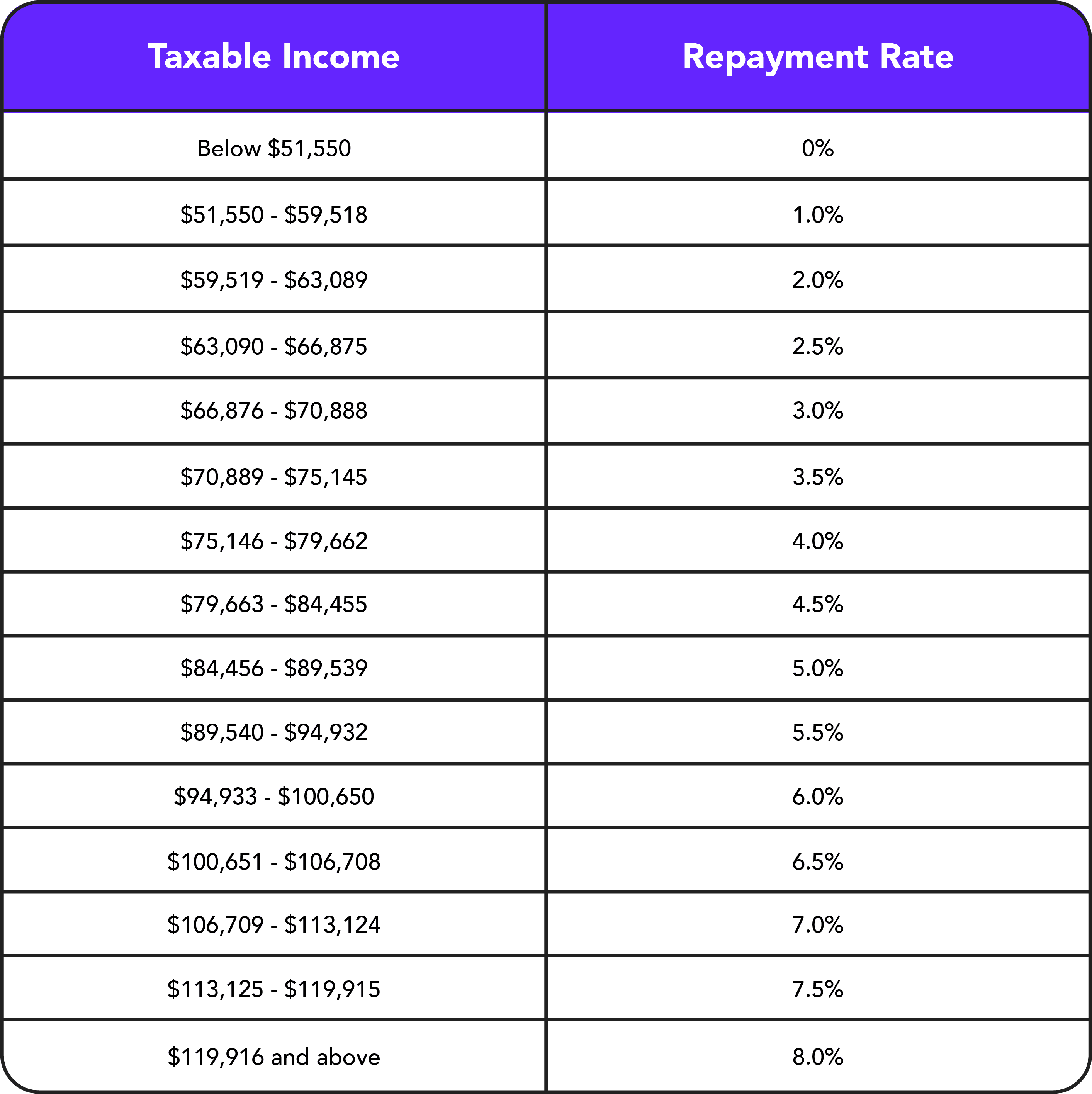

For the 2024-25 financial year, the repayment rates are as follows:

You can check out the repayment thresholds for the 2024-25 financial year, as well as for previous years here.

How to Use a HECS Repayment Calculator

By using an HECS repayment calculator, you can estimate how much you’ll be paying annually based on your income. Here’s a quick guide on using it.

#1 Enter Your Taxable Income

This includes your salary, wages, and any other taxable earnings.

#2 Input Your HECS-HELP Debt Balance

This helps the calculator give you a better picture of how long it will take to repay your loan.

#3 Select the Financial Year

The repayment rates change each year, so make sure you're using the latest thresholds.

#4 Review Your Estimated Repayments

The calculator will show how much you'll need to pay annually and the percentage of your income that goes towards your HECS debt.

Using the ATO HECS Repayment Calculator

The ATO’s Study and Training Loan Repayment Calculator is a solid choice to estimate your HECS repayments based on your taxable income. You can use it to calculate repayments for several study and training loan accounts. These include HELP, VET Student Loan (VSL), Student Financial Supplement Scheme (SFSS), Student Start-up Loan (SSL), ABSTUDY Student Start-up Loan (ABSTUDY SSL), and Australian Apprenticeship Support Loan (AASL).

Additionally, it helps estimate the overseas levy for HELP, VSL, and AASL for Aussies residing abroad. The hierarchy in which the compulsory repayment is applied is HELP, VSL, SFSS, SSL, ABSTUDY SSL, and AASL.

It’s important to keep in mind that the HECS Repayment Calculator will only give you an estimate based on the details you provide. To find out your exact repayment or overseas levy, you must first lodge your tax return.

Why Use a HECS Repayment Calculator

Firstly, it will be of great help for you to plan your budget. With a HECS Repayment Calculator, you can get an estimation of how much of your salary you’ll have to allocate for HECS Repayments. This will help you better organize your finances.

Secondly, using a HECS Repayment Calculator will help you avoid underpayments. For example, if you are self-employment or working multiple jobs, your income can change from month of month. By calculating your repayments in advance, you can make sure you set aside enough money.

Thirdly, it will help you estimate how long it will take to pay off your debt. It will give you an idea of how your repayments will affect your total balance over time.

Lastly, using an HECS Repayment Calculator will adjust your withholding tax if needed. If you’re worried about a surprise tax bill, you can request additional tax deductions from your employer.

End Notes

You don’t have to feel overwhelmed when managing your HECS-HELP debt. With a HECS repayment calculator, estimating your repayments becomes effortless. Planning out your financials so you can get loose control of your student loan becomes possible. If you want to avoid unwanted tax bills, budget better, or settle your debt faster, a single calculation can help you out significantly.

Want to put an end to the guessing game while estimating your HECS repayments? Check out ATO’s Study and Loan Repayment Calculator.

Subscribe to our weekly newsletter!

Tax breaks in your inbox! Subscribe now.

You can easily unsubscribe from future emails at any time.

Compare us with!