May 22, 2025

Tax Deduction Mistakes: How They Can Delay Your ATO Refund Estimate (2024–25)

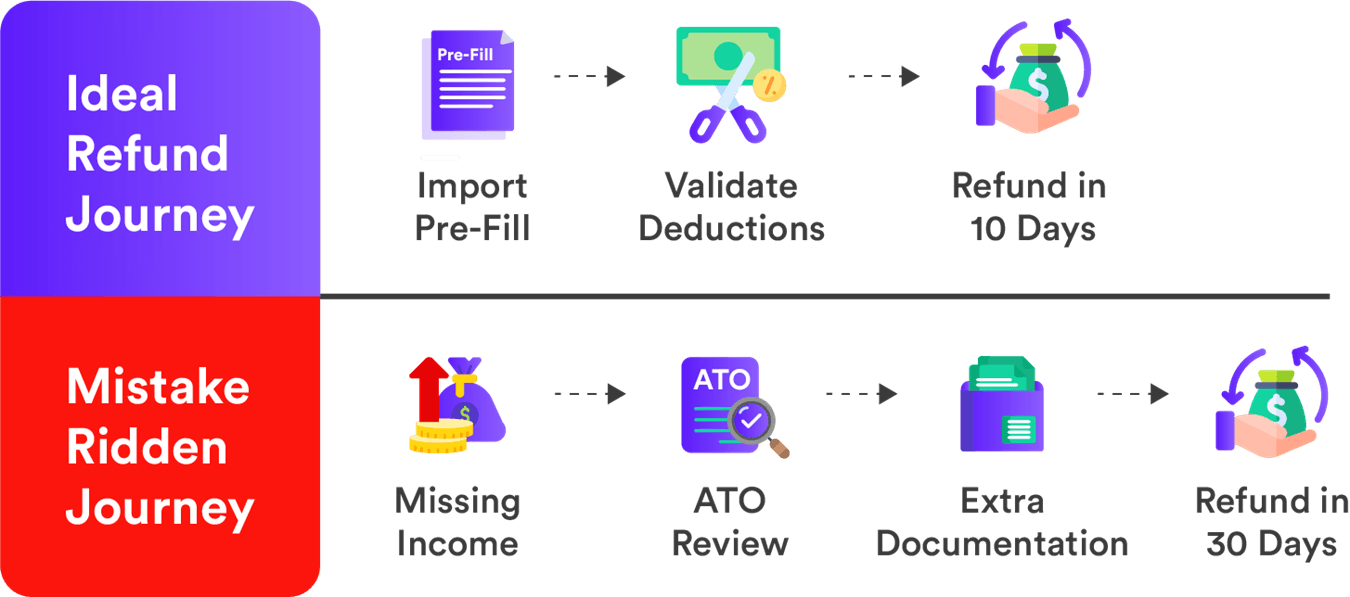

Tax deduction mistakes can turn what you expect to be a healthy ATO refund into a debt notice or delay your payment for weeks. This guide breaks down the most common tax deduction mistakes, highlights how they can lead to tax refund mistakes and shows you how to accurately estimate your tax refund on the first go.

Quick Tips

- Double-check all income sources with ATO prefill data.

- Stick strictly to ATO rules, no guesswork.

- Don’t forget offsets, rebates, or existing debts.

- Use a tax calculator built for Aussies to estimate tax refund figures before you lodge.

Common Tax Deduction Mistakes (and How to Fix Them)

Missing Extra Income

Mistake – Forgetting to include income from casual jobs, dividends, or crypto trading leads to incorrect deductions and an inflated refund estimate.

Fix – Match your records with ATO prefill. Import CSVs from your bank and exchanges into Lodge Pro so no income is missed.

Claiming Everyday Costs

Mistake – Everyday clothes, takeaway coffee, or your phone bill often sneak in as deductions.

Fix – Check each item against the ATO’s deduction rules. Only occupation-specific, protective or logo-branded clothing counts. For your phone, log usage for four weeks to calculate your work-related percentage.

Mixing Home Office Methods

Mistake – Using both the fixed rate (67c/hour) and actual costs for things like electricity or internet can lead to double claiming, and trigger an audit.

Fix – Choose one method only, fixed rate or actual costs and stick with it.

Ignoring Depreciation Rules

Mistake – Instantly claiming a deduction for items over $300 or forgetting to depreciate eligible tools over time.

Fix – Apply the $300 immediate deduction rule properly. Use ATO depreciation schedules for tools and equipment over that amount.

Not Splitting Shared Costs

Mistake – Claiming 100% of car or internet expenses when using them privately.

Fix – Keep a four-week logbook or diary and claim only the work-related percentage.

Why It Matters

Every one of these mistakes can impact your refund calculation. The ATO's risk filters flag these common tax refund mistakes, which could delay or reduce your ATO refund.

Offsets, Debts & Their Hidden Impact on Your Refund

Even a perfect deduction schedule can be undone by missed offsets or undisclosed debts:

Factor | Effect on refund | Action |

Low Income Tax Offset | Boosts refund up to $700 | Lodge Pro automatically applies it based on your income |

Private Health Rebate | Adds or removes credit | Enter actual premiums to avoid recalculation |

Refund diverted to debt | Check your balance in MyGov before you lodge | |

Child Support Arrears | Partial refund withheld | Clear or set up a payment plan first |

Missing any of these can lead to incorrect estimates or delayed payments.

Why Free Tools Can Cause Tax Refund Mistakes

Most free online tools don’t account for recent Budget changes and can struggle with rental schedules, capital gains, or multiple PAYG summaries. Lodge Pro’s estimator pulls live tax tables, state levies, and deduction benchmarks, allowing you to estimate your tax refund, even for complex situations, confidently.

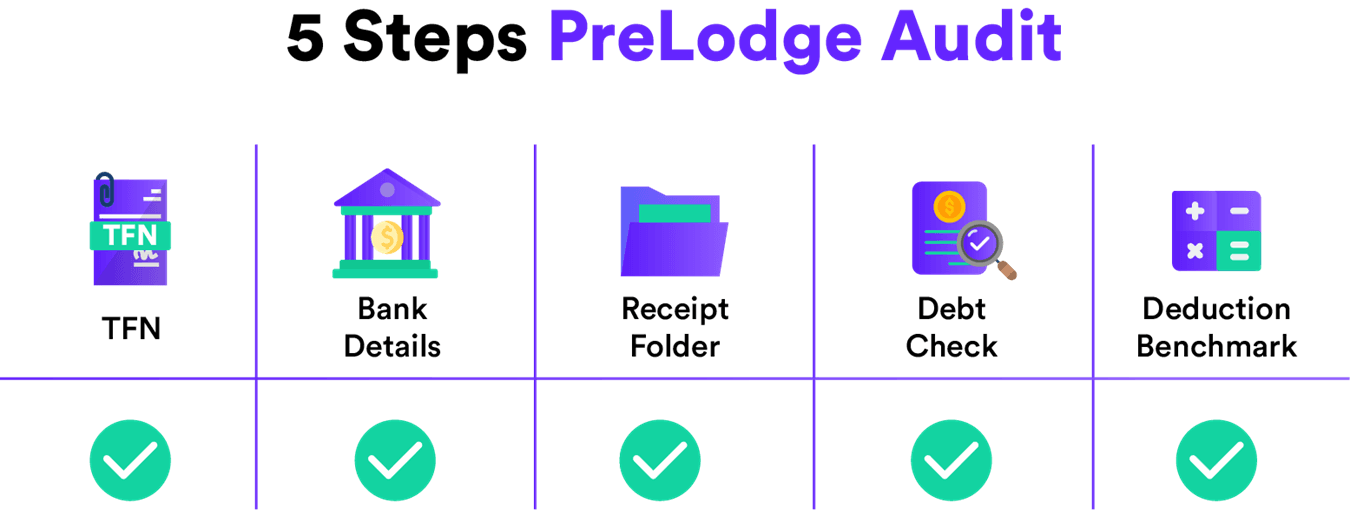

Checklist to Avoid Tax Refund Delays

- Import ATO prefill data – Match your TFN, income, dividends and bank interest

- Double-check deductions – Use Lodge Pro’s AI to benchmark claims

- Confirm bank details – Ensure BSB and account name match ATO records

- Review offsets & debts – Check your MyGov “Accounts & payments”

- Export a digital receipt bundle – Keep records for five years

Nail these five steps and you’ll avoid 90% of common refund delays.

How Lodge Pro Prevents ATO Refund Issues

Lodge Pro feature | Your benefit |

Secure Open Banking connections | Automatically captures all your income and expenses, nothing missed. |

AI Deduction Checker | Flag unusual claims before they raise ATO red flags |

AI Deduction Checker | Allows you to adjust entries and instantly see changes in your tax refund estimate. |

Pre-lodgement Validation | Confirms TFN, bank details and offsets in seconds. |

Optional CPA Support | A registered agent can answer ATO audit questions on your behalf |

Ready for an accurate refund Estimate?

Don’t let tax deduction errors cost you. Use Lodge Pro’s free calculator to avoid tax deduction mistakes, catch tax refund mistakes early, and estimate your tax refund amounts in under a minute.

Subscribe to our weekly newsletter!

Tax breaks in your inbox! Subscribe now.

You can easily unsubscribe from future emails at any time.

Legal & Professional

Features

Tax Checklist by Profession

Contact

Lodge Pro acknowledges the Traditional Owners of Country throughout Australia and recognises their connection to land, water and community. We pay our respects to them and their cultures, and to Elders past, present and emerging.

Compare us with!

© 2025 Lodge Pro Tax Portal. All rights reserved.