May 26, 2025

Maximise Your Tax Refund in 2025 - Proven Tax Refund Tips

Get back every dollar you’re owed with these smart, ATO-compliant tax refund tips! Getting back what you're entitled to at tax time doesn’t need to be stressful. If you're wondering, how can I estimate my tax refund before I lodge? You’re in the right place. This guide is packed with proven strategies to help you avoid common tax deduction mistakes, maximise your tax refund in 2025, and steer clear of those unwanted tax refund mistakes. Plus, we’ll show you a free tool to estimate your tax refund in seconds.

Let’s break it down so you can lodge confidently, stay 100% ATO-compliant, and pocket every dollar you’ve earned.

Quick Tax Refund Tips:

● Track from 1 July – Not in June panic mode.

● Use ATO pre-fill plus AI smarts – Uncover hidden deductions automatically.

● Review your offsets yearly – Low Income Tax Offset (LITO) and Seniors and Pensioners Tax Offset (SAPTO) thresholds can change after each Budget.

● Don’t wait ‘til the last minute – Lodge by 31 October to avoid late penalties.

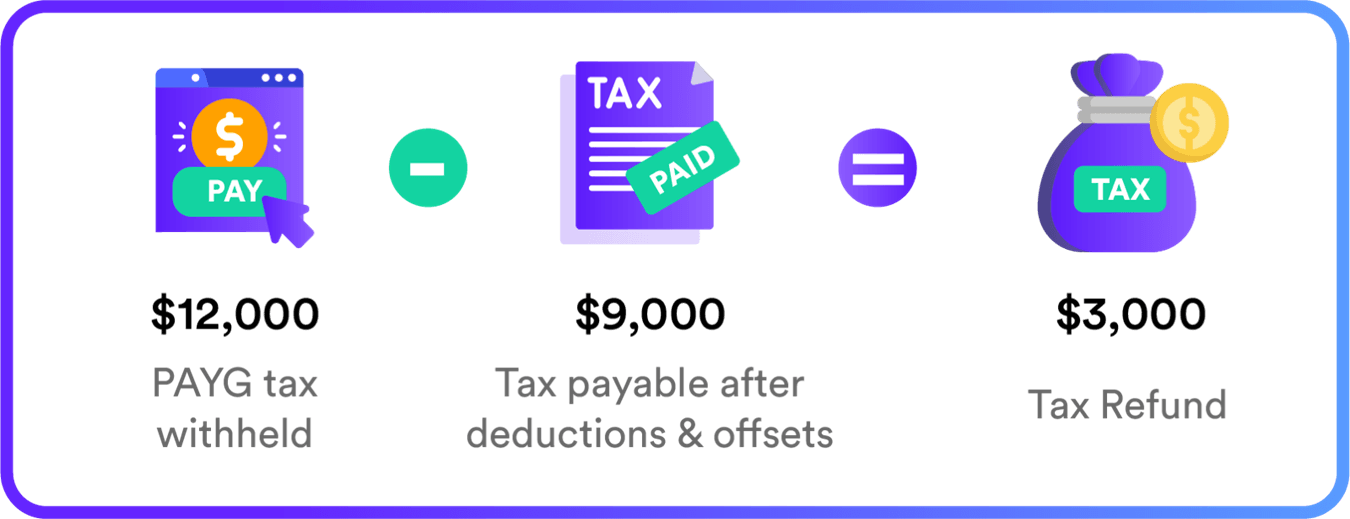

How Your Tax Refund Is Calculated

Your employer withholds tax based on standard scales. The ATO repays the over-withheld amount if your actual taxable income is lower due to legitimate deductions.

Term | Simple definition | Where you see it in MyTax |

Assessable income | Salary, bank interest, dividends, crypto gains, gig-economy earnings | Income statements |

Deductions | Expenses directly tied to earning that income | Deductions tab |

Offsets | Dollar-for-dollar reductions in calculated tax (not income) | Tax offsets tab |

Pro Tip: Deductions reduce your taxable income, while offsets slash your tax bill.

Use both to maximise your refund!

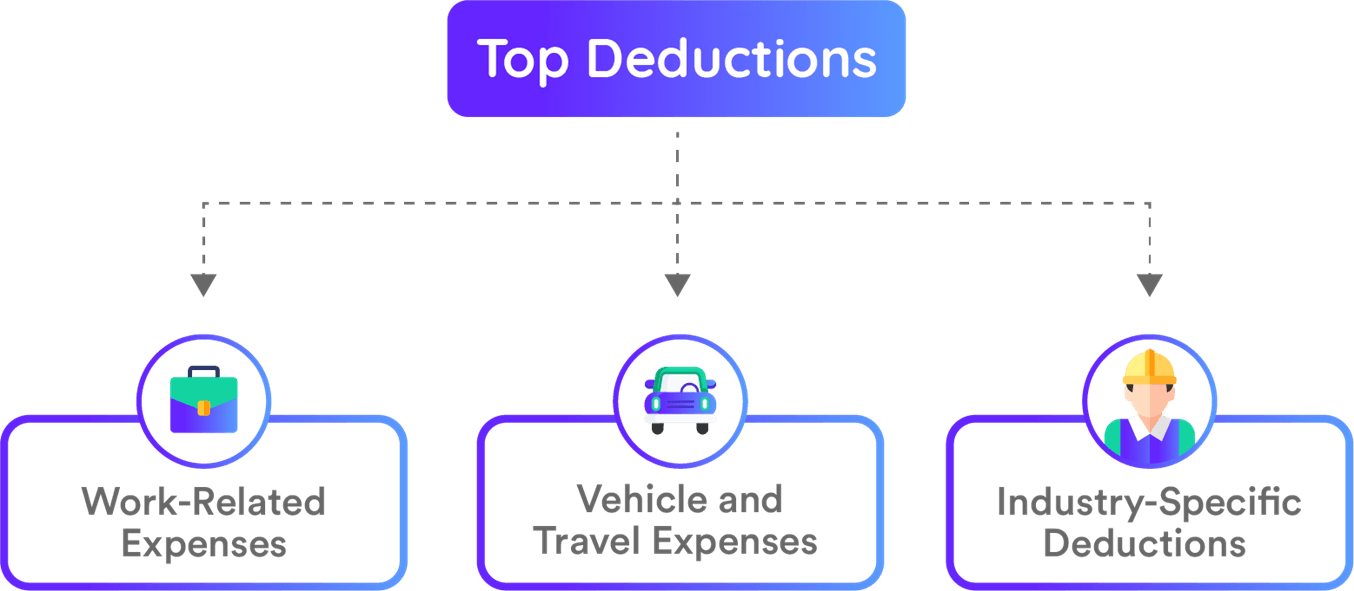

Top Deductions People Often Forget

Work-Related Expenses

Category | What you can claim |

Home-office costs | From 1 July 2023, the fixed rate is 67c per hour, covering electricity, gas, phone, internet, computer consumables, and stationery. You can’t claim those items separately. Keep a diary of hours worked. If your actual expenses exceed the fixed rate, Lodge Pro’s AI will suggest switching to the actual-cost method and help you calculate depreciation. |

Work-related phone & data | Take a three-month sample of your bill, highlight business calls, calculate the business percentage, and apply it to the year. Keep your annotated bill as evidence. Lodge Pro’s AI checks your claim against ATO benchmarks to ensure it's reasonable. |

Self-education | Claim the costs of courses, micro-credentials, workshops, and textbooks to improve skills for your current role. Lodge Pro’s AI cross-checks course topics against ASIC and industry databases to confirm relevance, reducing your audit risk. |

Protective clothing & equipment | Claim items like steel-cap boots, safety glasses, and uniforms with a permanent logo. Keep purchase receipts. If you use a laundry service, keep those receipts, or claim the ATO’s $1 per load shortcut. |

Professional subscriptions & union fees | This includes memberships like CPA Australia, Nursing & Midwifery Board, trade unions, and even essential subscriptions like LinkedIn Premium. Ensure the subscription is in your name. |

Depreciable tools & tech | Assets under $300 are an immediate deduction; assets above $300 are depreciated. |

Vehicle & Travel - Choose the Right Method

If you drive between worksites or carry bulky equipment:

Method | How it works | Best for |

Cents-per-kilometre | Claim up to 5,000 km at 85¢/km (2024-25); no logbook required, but keep a diary of work trips. | Occasional work travel. |

Logbook | Keep a 12-week logbook and apply your business-use percentage to all running costs (fuel, registration, insurance, servicing, depreciation). | Regular or high-kilometre work travel. |

Industry Specific Deductions

Occupation | Often-missed deductions |

Nurses & midwives | Scrubs, fob watches, indemnity insurance, shift-meal allowance top-ups. |

Teachers | Classroom decorations, educational apps, USB drives, and first-aid courses. |

Tradies | Tool insurance, site licences, and dog-handler training for security installers. |

Rideshare drivers | Car washes, phone mounts, bottled water for passengers, and P-plate costs. |

IT contractors | Cloud-service subscriptions, ergonomic chairs, and certification exam fees. |

Often-Missed “Micro-Claims”

- Union or professional association fees.

- Work-required phone calls on bundled mobile plans.

- Income-protection insurance premiums.

- Bank fees on a dedicated work-expenses credit card.

- Sun-protection for outdoor workers (e.g., SPF 50+ sunscreen, sunglasses).

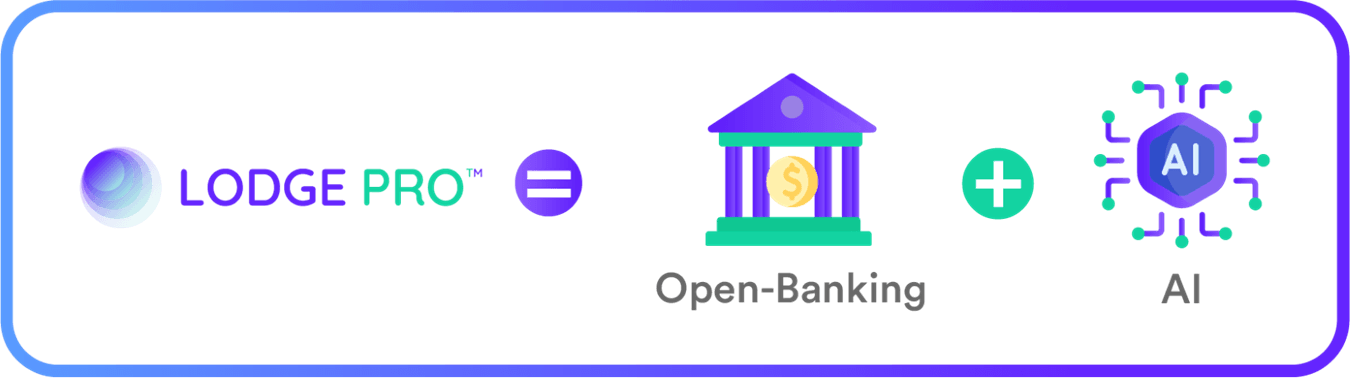

Using Lodge Pro: Open-Banking + AI

With Lodge Pro, you can simplify your tax return process:

- Secure Bank Feeds: Automatically import every debit and credit transaction.

- AI Deduction Engine: Clusters similar merchants and flags outliers, such as multiple Officeworks visits tagged as office supplies.

- Real-Time Refund Tracker: Updates as you accept or edit each suggestion.

- Optional CPA Review: A flat fee human review provides assurance without forced upsells.

This hybrid approach means you control what’s claimable while the AI handles the paperwork.

Boost Your Refund with Offsets & Rebates

Offset | Who qualifies in 2024-25 | Maximum |

Low Income Tax Offset (LITO) | Taxable income ≤ $ 66,667 | Up to $700 |

Seniors & Pensioners (SAPTO) | Eligible seniors, some veterans | Up to $ 2,466 for couples |

Super income-stream | Under 60, receiving taxed element pension | 15 % of taxed element |

Zone tax offset | Living in remote zones A/B | $191–$570 depending on zone & dependants |

Timing & Tax Deadline Hacks

Date | Action |

1 July | ATO opens e-lodgement; early-birds start filing. |

Mid-July → Early Aug | ATO pre-fill data (PAYG, interest, private health) completes. |

31 Oct | DIY deadline - late fees can be up to $ 1,565. |

May → Jun | Register with a tax agent if you’ll miss 31 Oct; this extends the due date to May next year. |

Lodge Pro alerts you if you’re missing any pre-fill info, so no surprises post-lodgement.

Real-Life Success Stories

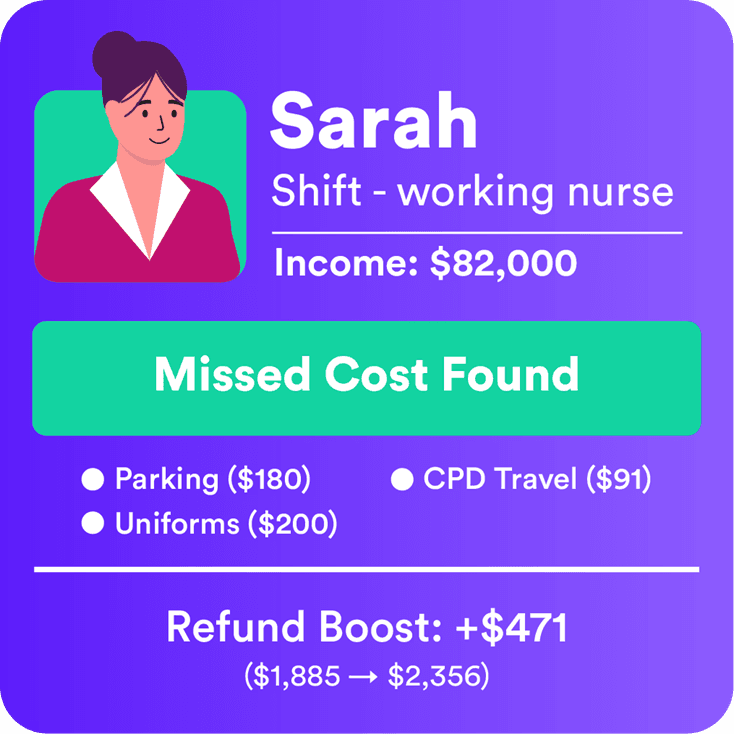

Sarah – Shift-working nurse

- Income: $ 82,000

- Missed costs found parking ($180), uniforms ($200), and CPD travel ($91).

- Refund boost: +$471 (from $ 1,885 → $ 2,356).

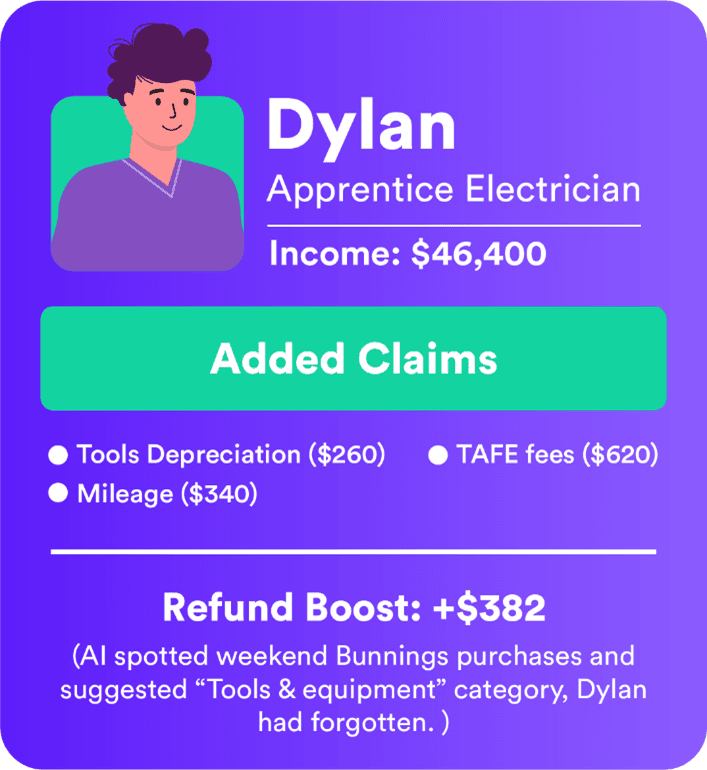

Dylan – Apprentice electrician

- Income: $ 46,400

- Added claims: tools depreciation ($260), TAFE fees ($620), mileage ($340).

- Refund boost: +$382.

Note: Lodge Pro AI spotted weekend Bunnings purchases and suggested: “Tools & Equipment” category, which he had forgotten.

Advanced Strategies for 2025

- Salary-packaged devices - If your employer offers FBT-exempt portable devices (laptop, tablet, phone), you can sacrifice pre-tax dollars instead of claiming depreciation later.

- Super top-up deductions - Consider making personal concessional contributions (up to a combined cap of $27,500). Lodge Pro’s prompts can help auto-calculate any unused cap carry-forward.

- Investment-property edge cases - Immediate deductions for repairs vs. capital works. Lodge Pro can prompt a photo upload while a CPA review checks invoice language (repair vs. improvement)

- Crypto-loss harvesting - Offset capital gains with carried-forward crypto losses. Exchange CSV imports can map to the correct CGT form labels.

- Work-from-anywhere allowances - Some employers pay a remote allowance; you can still claim running costs if it's taxed as salary. Keep a four-week representative diary to support your usage split.

Record-Keeping Like a Pro

Requirement | Plan |

Receipts ≥ $300 total | ATO accepts clear photos (must show seller, date, amount, nature) |

Vehicle logbook 12 weeks | Spreadsheet + fuel dockets |

Depreciation schedules | Manual Division 40 worksheet |

Five-year storage rule | Export ZIP archive annually |

Pro Tip: Set a monthly 15-minute “receipt check” reminder. No more June chaos!.

Next Steps – Turn Tips into Dollars

- Create your free Lodge Pro account - No credit card required.

- Connect your bank via secure Open-Banking feeds.

- Review AI-flagged deductions - keep, edit or discard with one tap.

- Submit to ATO and watch the real-time refund tracker.

Average Lodge Pro user boosts their refund by $410 versus manual filing.

Start My AI-Powered Return Now! →