This section helps you claim refundable tax offsets - meaning if your offsets are worth more than the tax you owe, you could get the extra money back as a refund.

These offsets are designed to give you extra financial support, especially if you’re caring for someone with a disability or have invested in approved exploration activities. Claiming them can lower your tax bill - and might even increase your refund if you’re eligible.

Who Can Claim Other Refundable Tax Offsets?

You may be eligible for a refundable tax offset if you meet any of the following criteria:

- Beneficiary Special Disability Trust (S) - If you are a beneficiary of a Special Disability Trust, you may be entitled to a refundable tax offset.

- Multiple Tax Offsets (M) - If you qualify for more than one refundable offset, you must select this option and provide details.

- Exploration Credit Refundable Tax Offset (E) - If you have received an exploration credit, you may be able to claim this offset.

For more details on eligibility, refer to the Australian Taxation Office (ATO) website or feel free to contact us.

How to Enter Other Refundable Tax Offsets (H2)

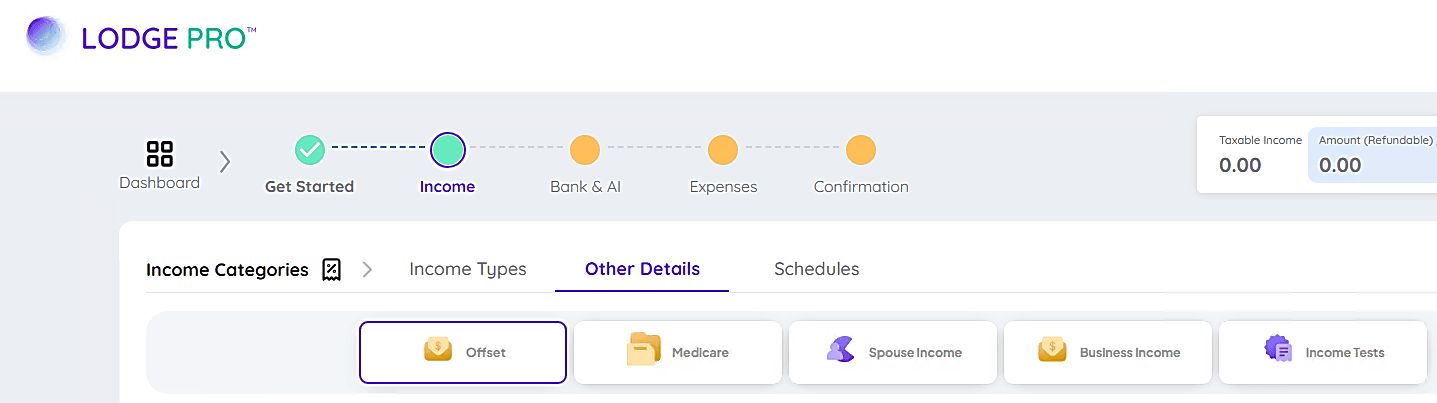

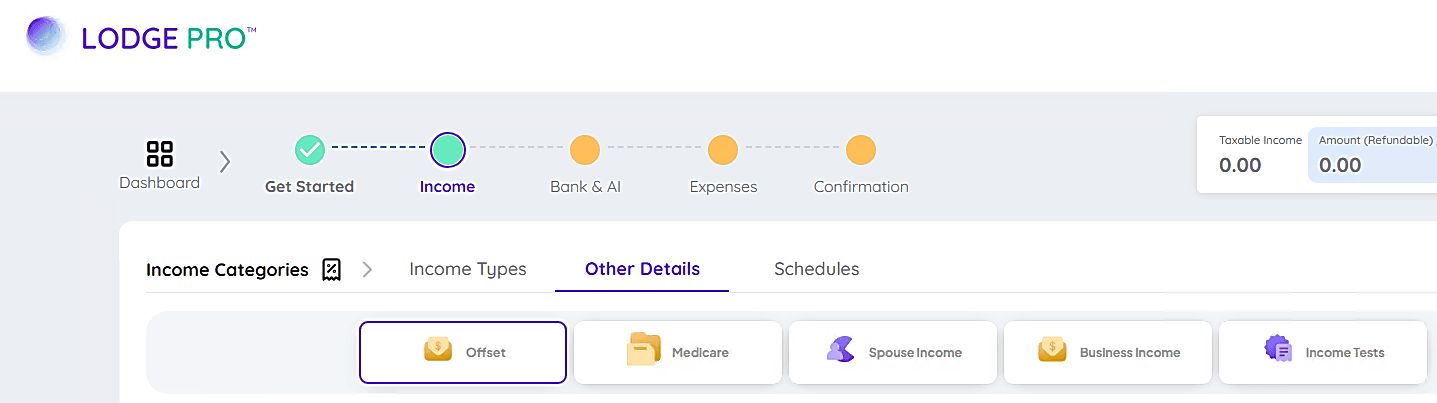

To enter the Other Refundable tax offset, go to the Income section, then navigate to Other Details, and from there proceed to the Offset section where you’ll find and access Section T9 to input the relevant tax offset information.

The system makes it simple to enter multiple refundable tax offsets.

Follow these steps:

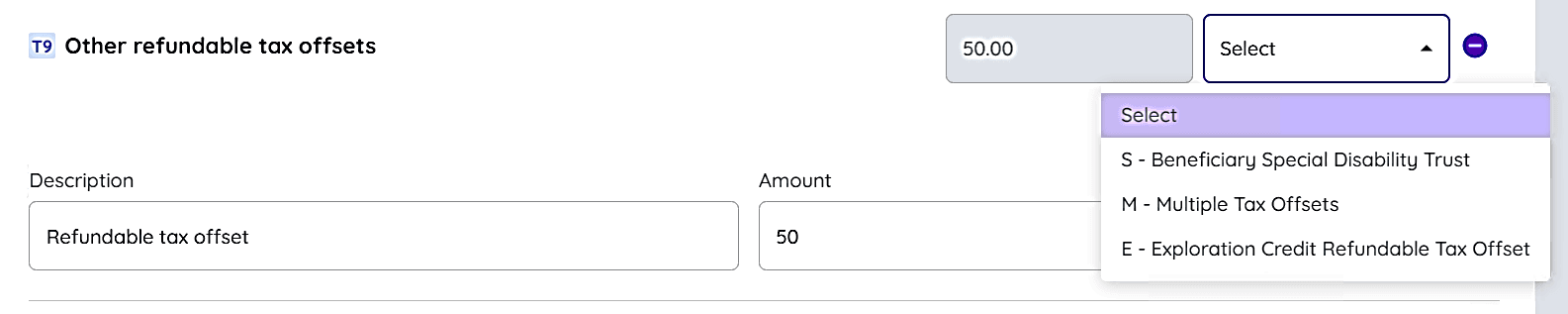

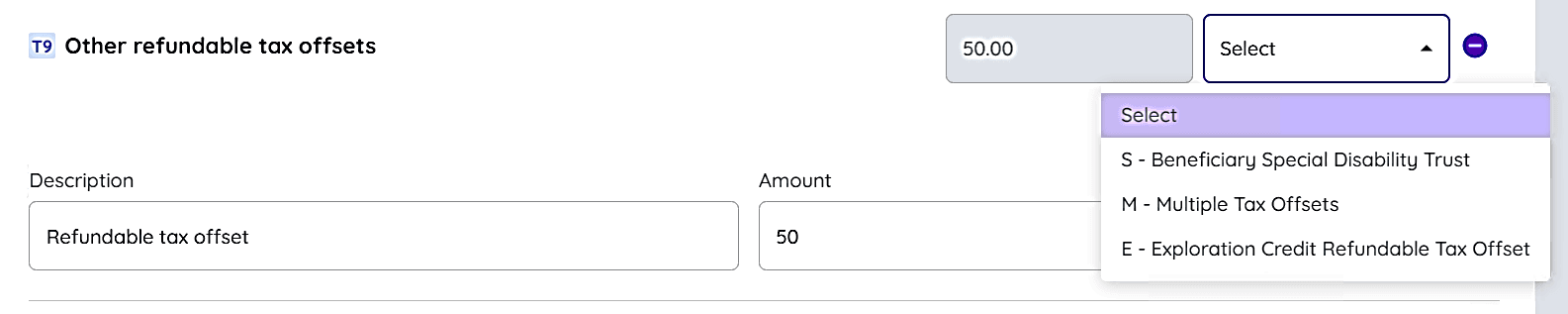

- Click the plus (+) icon to expand the Other Refundable Tax Offsets section.

- Enter the following details for each offset:

- Description - A brief explanation of the offset (e.g., "Beneficiary Special Disability Trust").

- Description

- Amount - The dollar value of the refundable tax offset.

- Select - Choose the correct category from the dropdown menu:

Additional Tax Offset and Liability Information (H3)

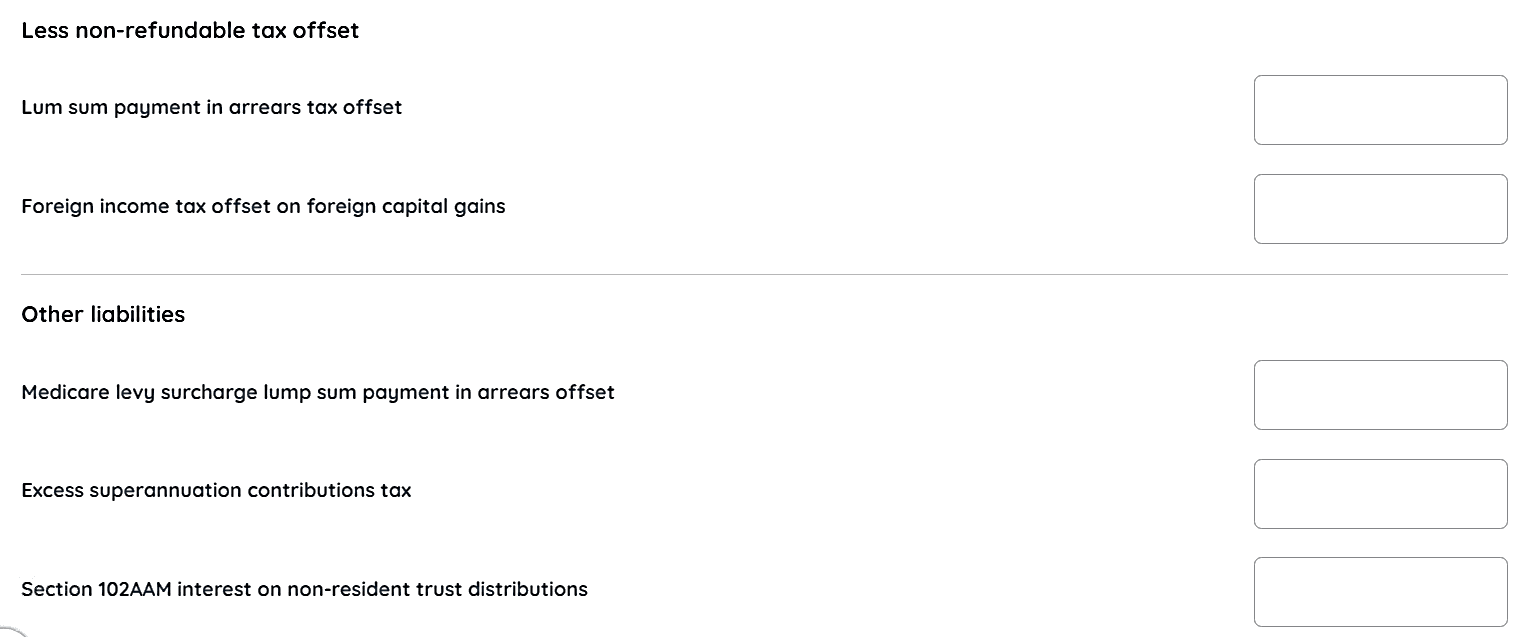

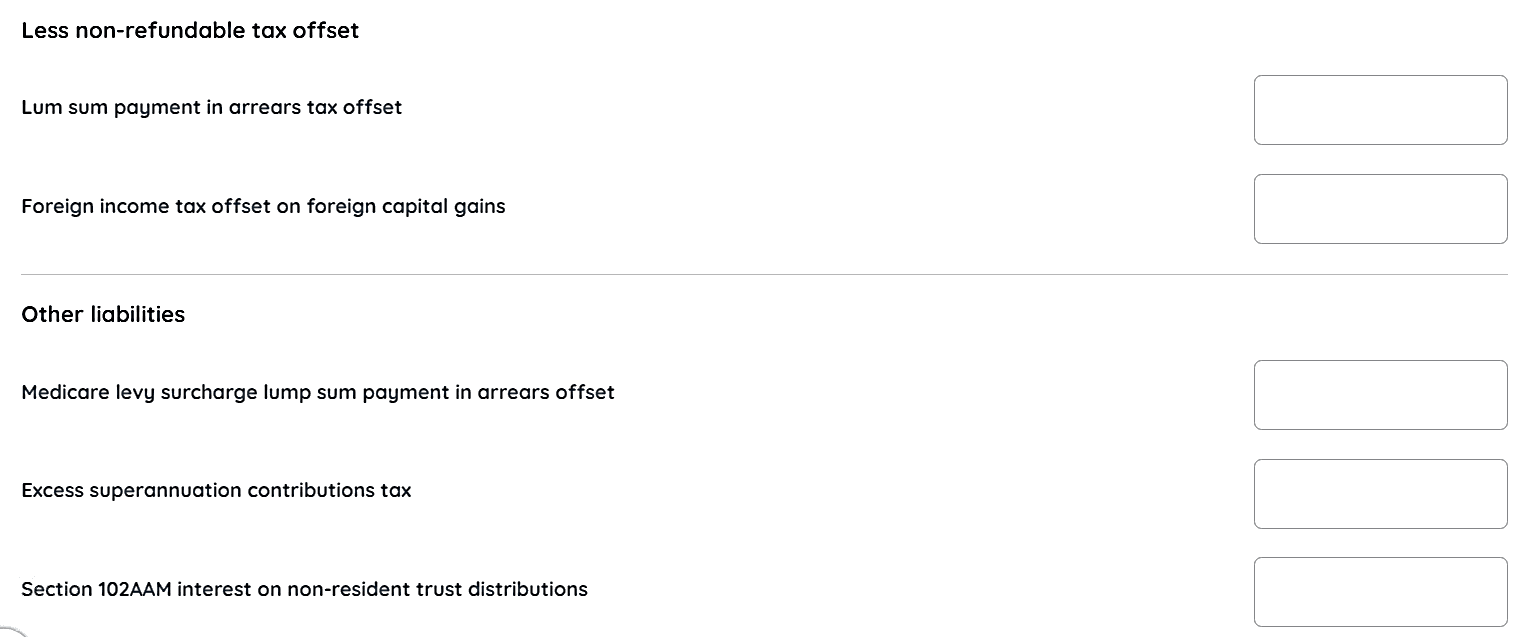

- Review Non-Refundable Tax Offsets

- Check if you are entitled to a lump sum payment in arrears tax offset.

- Confirm if you qualify for a foreign income tax offset related to foreign capital gains.

- Verify Other Liabilities

- Review whether you have any Medicare levy surcharge lump sum payment in arrears offsets.

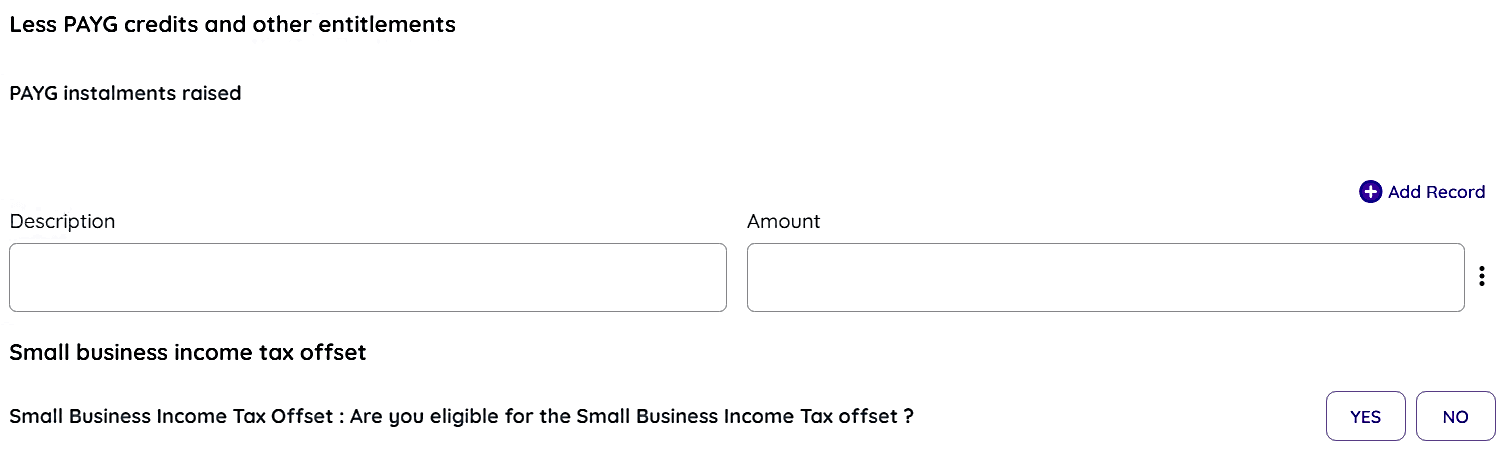

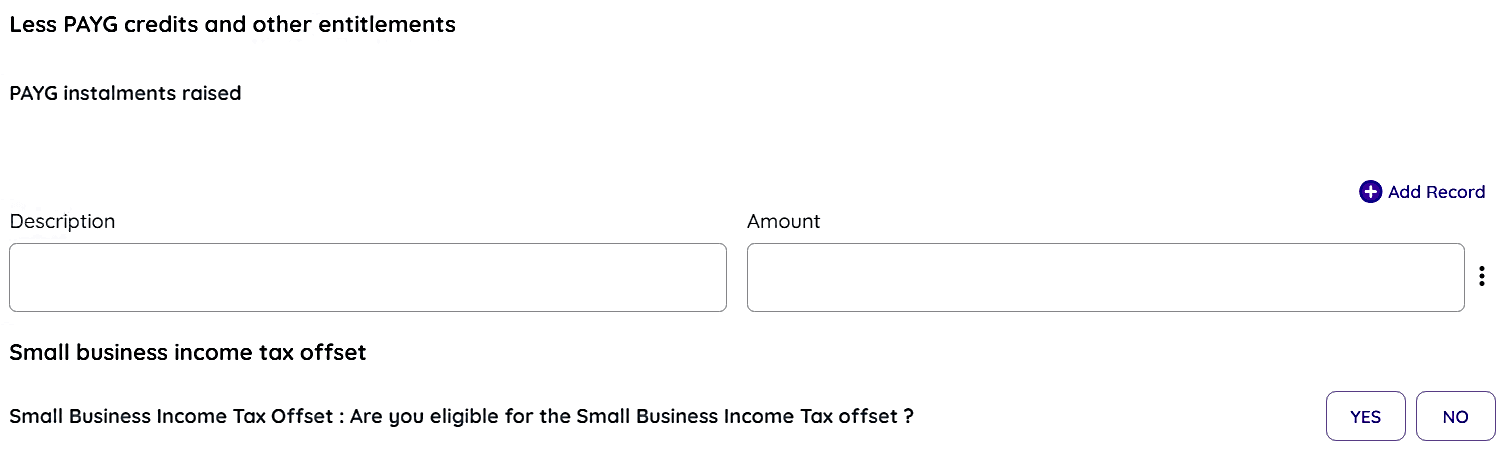

Less PAYG Credits and Other Entitlements (H3)

- Review PAYG Instalments

- Make sure all PAYG instalments raised during the year are correctly entered in the system.

Small Business Income Tax Offset

- Check Your Eligibility

Ensure all details are correct before submitting your tax return.

Managing Other Refundable Tax Offset Records (H2)

- Add multiple records easily by clicking the Add New Payment button.

- Edit, delete, or view individual records whenever needed.

- Before a record is deleted, a confirmation popup will appear to help prevent accidental loss of data.

If you need further assistance, feel free to contact us.

Completing Your Supplementary Tax Return (H2)

To make sure your Other Refundable Tax Offsets are correctly applied, follow these steps:

- Review Your Entries

- Double-check that each offset description is accurate.

- Ensure the correct offset type (S, M, or E) is selected.

- Check the Total Amount

- Verify that the total offset amount is calculated correctly.

- Edit any entries as needed before finalising.

- Submit Your Tax Return

- After confirming all details, submit your supplementary tax return.

- Keep documentation for your claim in case of future audits or questions from the ATO.

For further details, feel free to contact us.

FAQs

Q: What are Other Refundable Tax Offsets and who is eligible?

A: These offsets help reduce your tax liability and may result in a refund if the offset amount is more than the tax you owe. You may be eligible if you are:

A beneficiary of a Special Disability Trust (S),

Entitled to multiple refundable tax offsets (M), or

Claiming an Exploration Credit Refundable Tax Offset (E).

Q: How do I enter my Other Refundable Tax Offset details in the system?

A: Click the plus (+) icon to expand the Other Refundable Tax Offsets section. Then enter:

A short description (e.g., "Beneficiary Special Disability Trust"),

The dollar amount of the offset, and

Select the appropriate offset type from the dropdown: S, M, or E.

If you need further assistance, feel free to contact us.

Q: Can I manage (edit or delete) my Other Refundable Tax Offset entries?

A: Yes. You can add, edit, or delete records at any time using the Add New Payment button or edit options. A confirmation popup will appear before deletion to help prevent accidental data loss.

Q: What should I check before finalising my tax return?

A: Make sure all entries are correct, the right offset type (S, M, or E) is selected, and the total offset amount is accurate. Also, review any PAYG instalments and confirm your eligibility for the Small Business Income Tax Offset before submitting.