The Early-Stage Venture Capital Limited Partnership (ESVCLP) Tax Offset is all about supporting innovation and growth in Australia. If you invest in an approved ESVCLP-basically, a fund that backs exciting new startups-you may be eligible for a non-refundable tax offset that you can carry forward to future years. It’s a smart way to back Aussie innovation while potentially reducing your tax bill.

Why Invest in an ESVCLP?

Investing in an ESVCLP means you’re helping Aussie startups grow while enjoying some great tax perks. You’ll get a tax offset not just for this year’s investment, but also for any unused offsets from previous years. That means you can spread out the benefit and make the most of your support for emerging businesses. It’s a win-win-support innovation and save on tax!

Who Can Claim the ESVCLP Tax Offset?

You may be eligible if:

- You’ve invested in a registered Early-Stage Venture Capital Limited Partnership (ESVCLP).

- Your investment qualifies under the government’s venture capital tax incentive scheme.

- The ESVCLP is approved by Innovation and Science Australia and meets requirements under the Venture Capital Act 2002.

- You’re an individual, company, or trust that made an eligible investment.

- You can carry forward any unused tax offset amounts, but they’re not refundable.

This offset is a great way to support innovation while getting rewarded at tax time!

For detailed eligibility requirements, refer to the Australian Taxation Office (ATO) website or feel free to contact us.

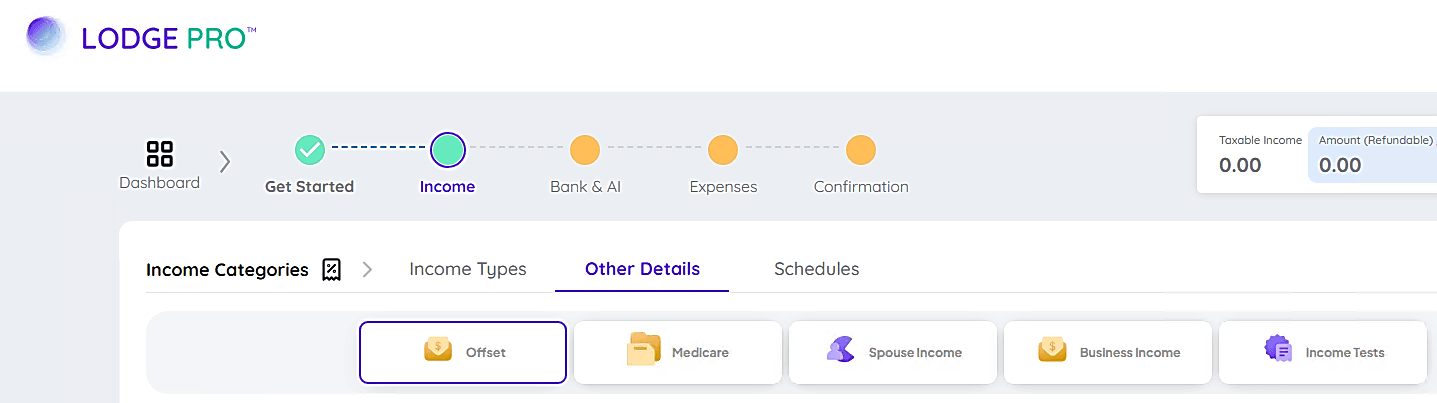

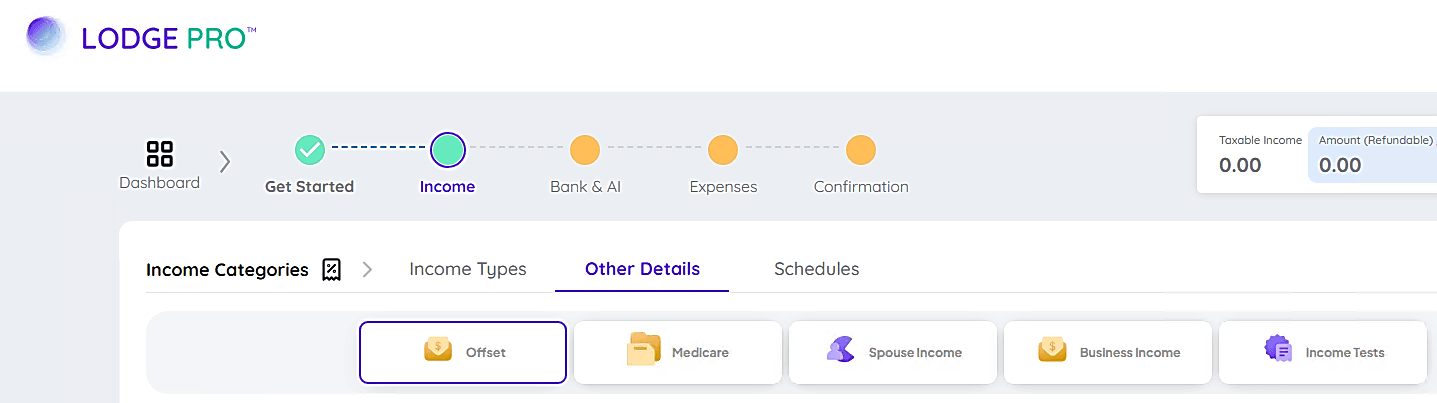

How to Enter Early-Stage Venture Capital Limited Partnership Tax Offset Details

To enter the ESVCLP tax offset, go to the Income section, then navigate to Other Details, and from there proceed to the Offset section where you’ll find and access Section T7 to input the relevant tax offset information.

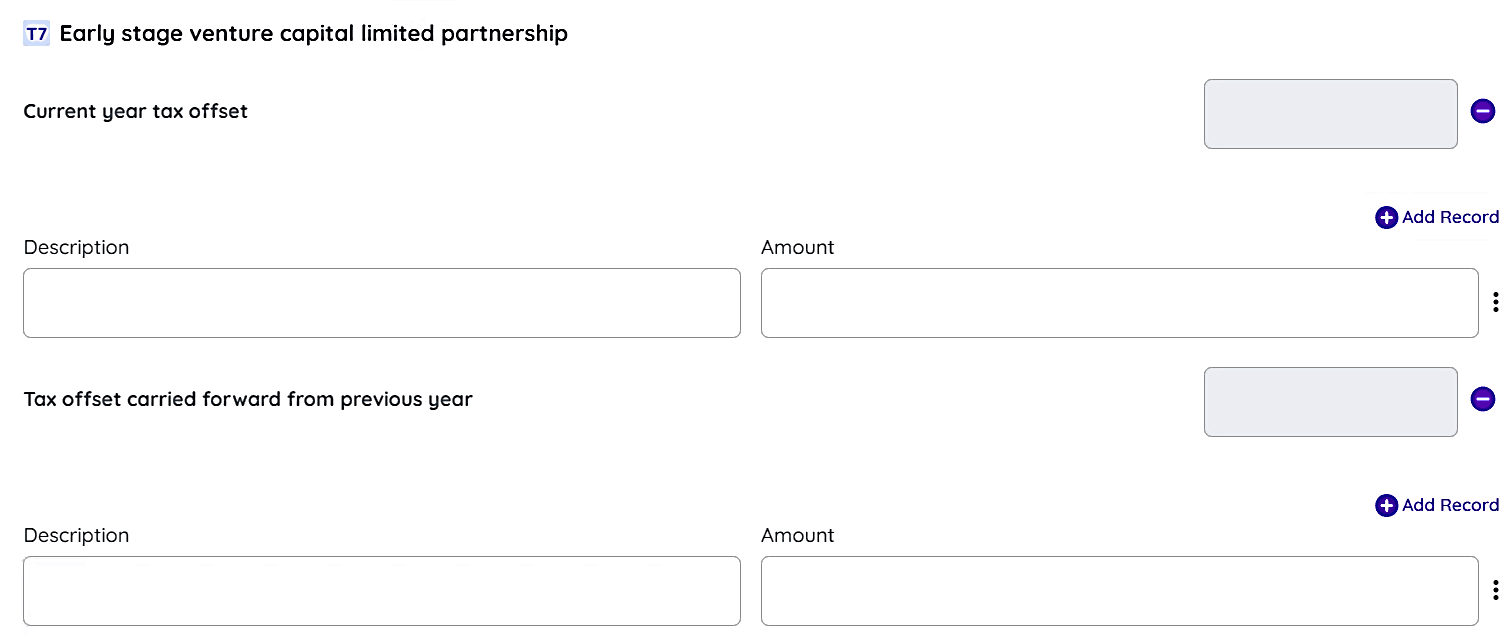

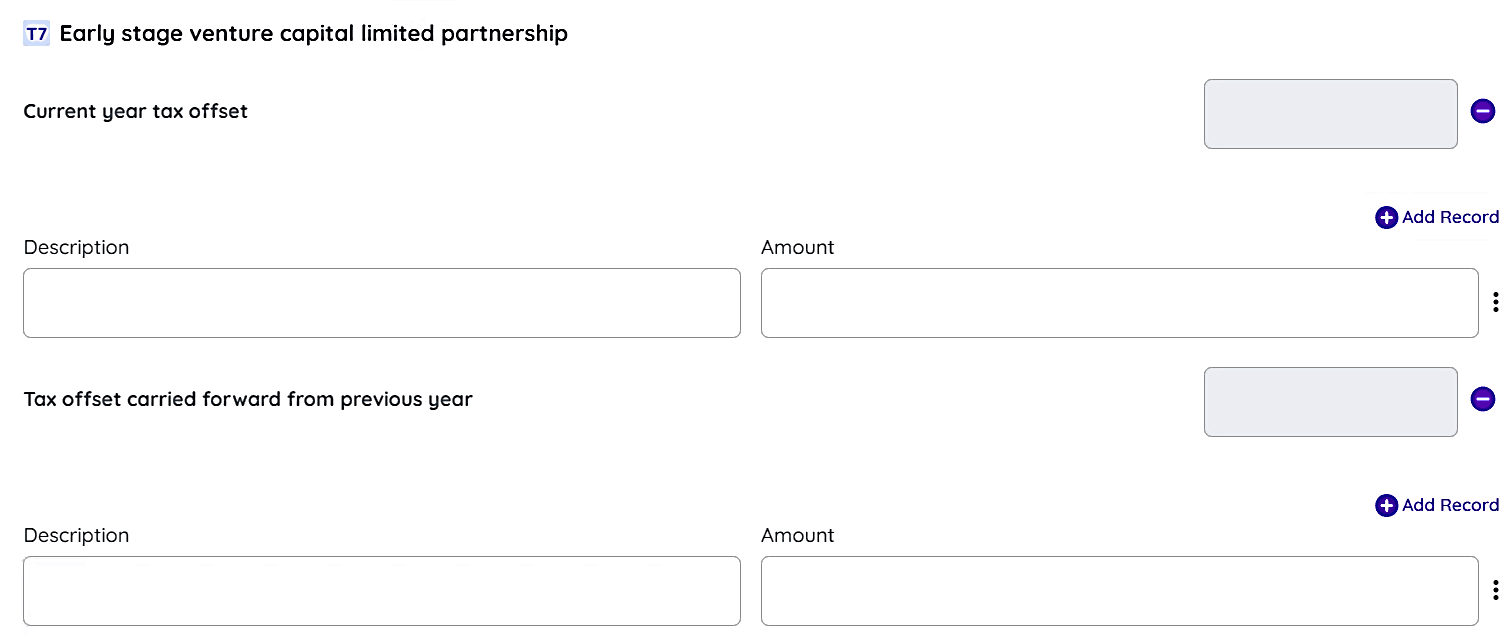

The system makes it easy to enter your ESVCLP tax offset details accurately. You can record:

- Current-year tax offset

- Carried-forward tax offset from previous years

Simply click to expand the section you need and enter the relevant details.

Current Year Tax Offset

Use this section to record any tax offsets earned from investments made during the current income year.

- Click the plus (+) icon to expand the section and enter your details.

- Fill in the following fields:

- Description - A short summary of your investment (e.g. Investment in XYZ ESVCLP Fund).

- Amount - The value of your eligible tax offset.

Once entered, the system will automatically display the total next to the Current Year Tax Offset field.

Managing Current Year Tax Offset Records

- Click Add New Payment to create additional entries.

- You can view, edit, or delete each record as needed.

- When deleting a record, a confirmation popup will appear to help prevent accidental removal.

Tax Offset Carried Forward from Previous Year

If you have unused tax offsets from earlier years, you can record them here.

- Click the plus (+) icon to expand the section.

- Enter the following:

- Description - e.g., “Unused offset from 2022-23”

- Amount - the dollar value of the carried-forward offset

- The system will automatically display the total amount next to this field.

Managing Carried-Forward Tax Offset Records

- Use Add New Payment to enter multiple offsets.

- You can view, edit, or delete records at any time.

- A confirmation popup will appear before deleting a record to help prevent mistakes.

Completing Your Supplementary Tax Return

To make sure your ESVCLP tax offset is applied correctly, follow these steps:

- Review Your Entries

- Check that all investment details are correctly entered.

- Make sure each description clearly explains the type of offset.

- Confirm Total Amounts

- Ensure both current-year and carried-forward offsets are accurate.

- Edit or delete any entries if needed before submission.

- Submit Your Tax Return

- When everything is final, go ahead and submit your supplementary tax return.

- Keep records of your investments in case they’re needed for future reference or audits.

For further guidance, feel free to contact us.

FAQs

Q: What is the ESVCLP Tax Offset, and who can claim it?

A: The Early-Stage Venture Capital Limited Partnership (ESVCLP) Tax Offset is a non-refundable tax offset that can be carried forward to future years. It’s available to individuals, companies, and trusts that invest in approved ESVCLPs under the Australian Government’s venture capital incentive scheme.

Q: How do I enter my ESVCLP tax offset details in the system?

A: The system separates entries into two sections for ease:

- Current Year Offset: Expand the section, then enter a short description and the eligible offset amount.

- Carried-Forward Offset: Expand the section and input details for any unused offsets from previous years. The system will automatically calculate totals for both sections.

If you need further assistance, feel free to contact us.

Q: Can I update or delete my ESVCLP tax offset records after entering them?

A: Yes, the system gives you full control. You can add, edit, or delete entries whenever needed. A confirmation popup will appear before any deletion to help prevent accidental loss of data.

Q: What should I review before submitting my tax return?

A: Make sure all offset details are accurate, including the total amounts for both current-year and carried-forward entries. Double-check your descriptions and keep supporting documents for your investments. Once everything looks good, you're ready to lodge your supplementary tax return.