T5 Invalid and Invalid Carer Tax Offset

If you’re caring for someone with a serious disability or medical condition, or supporting a carer who is, you may be eligible for this tax offset. It’s designed to help ease the financial load for those providing full-time care and support to someone in need.

Who Can Claim the Invalid and Invalid Carer Tax Offset?

You may be eligible if you supported a dependent who needed full-time care and met the following conditions:

Eligible Dependents Include:

- Your spouse - if they were an invalid or a carer of an invalid.

- A parent - yours or your spouse’s, if they were an invalid or a carer of an invalid.

- A child (aged 16 or older), sibling, or your spouse’s sibling - if they had a serious disability requiring full-time care.

Other Conditions:

- The dependent must have been an Australian resident for tax purposes.

- Their adjusted taxable income (ATI) must have been less than $12,042 in the financial year.

- They must have relied on you for financial support-covering essential costs like accommodation, food, medical care, and other daily living needs.

If their ATI was over $12,042, you generally won’t be eligible for this offset.

For further details, visit the Australian Taxation Office (ATO) website or please feel free to contact us through any omni channel (Email, WhatsApp, Messenger, SMS, and Phone call).

How to Enter Invalid and Invalid Carer Tax Offset Details

Entering your details is simple! The system is designed to make it easy for you to claim the Invalid and Invalid Carer Tax Offset.

Just follow these step-by-step instructions to get it done quickly and accurately.

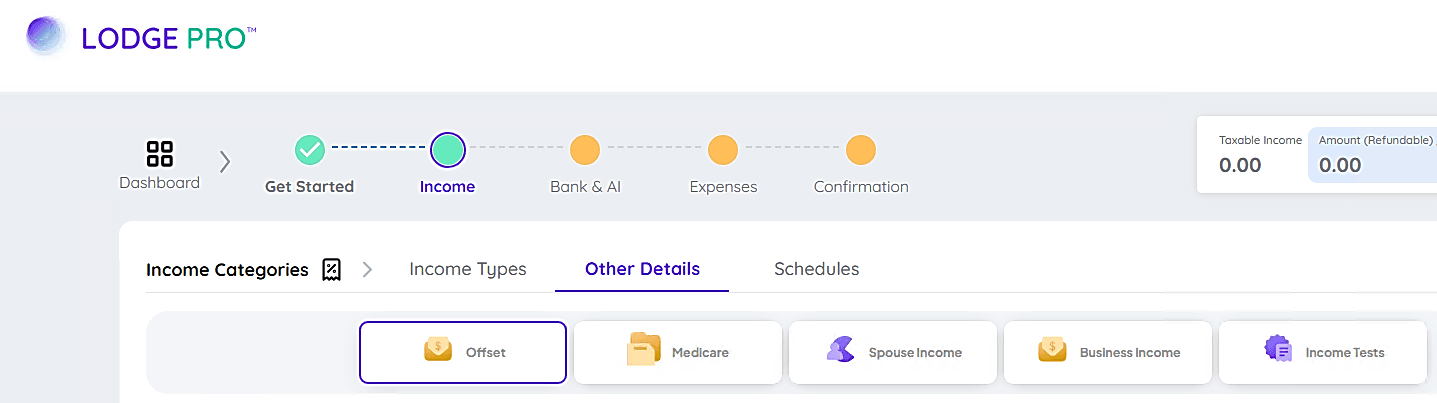

To enter the Invalid and Invalid Carer tax offset, go to the Income section, then navigate to Other Details, and from there proceed to the Offset section where you’ll find and access Section T4 to input the relevant tax offset information.

- Just click the plus (+) icon to expand the section and start entering your details. It’s that simple!

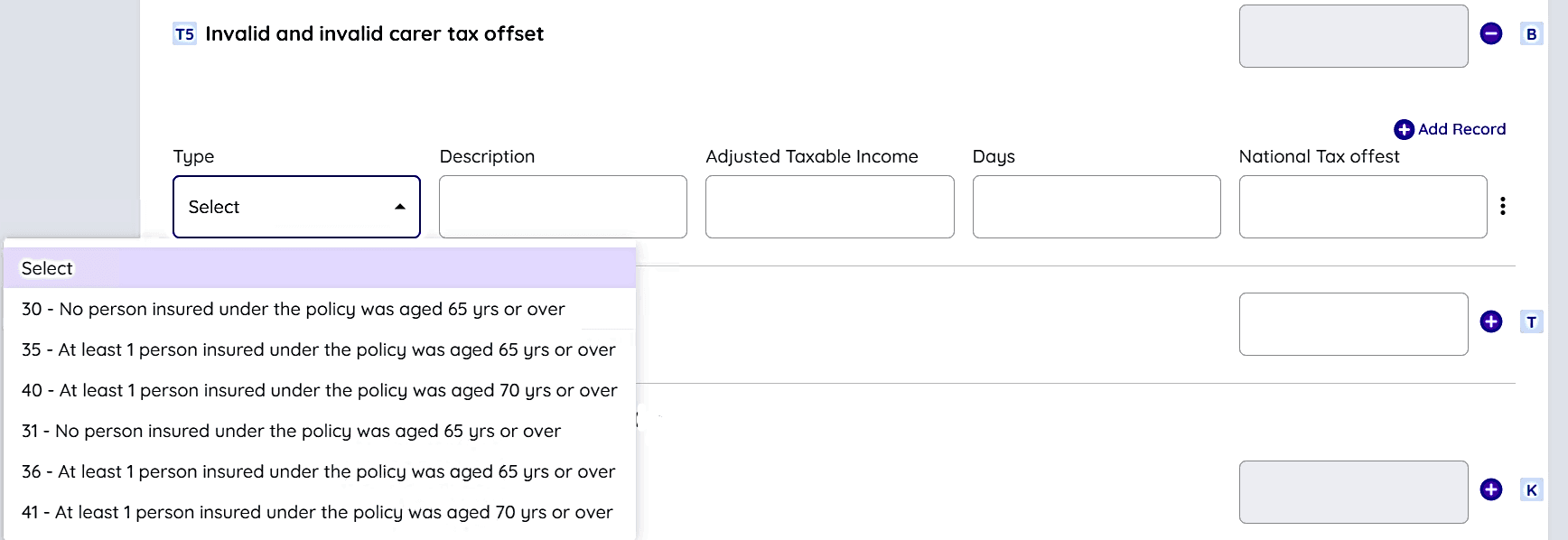

When you expand the section, you’ll be able to fill in the following fields:

- Type - A dropdown menu allows users to select the type of dependent they are claiming the offset for. The following options are available:

- 30 - No person insured under the policy was aged 65 years or over

- 31 - No person insured under the policy was aged 65 years or over

- 35 - At least one person insured under the policy was aged 65 years or over

- 36 - At least one person insured under the policy was aged 65 years or over

- 40 - At least one person insured under the policy was aged 70 years or over

- 41 - At least one person insured under the policy was aged 70 years or over

- Description - A text field where users can provide additional details about the dependent or care arrangement.

- Adjusted Taxable Income (ATI) - Users must input the adjusted taxable income of the dependent. If this exceeds the threshold of $12,042, the system will indicate ineligibility.

- Days - The number of days for which the offset applies must be entered in this field.

- Notional Tax Offset - This field is automatically calculated based on the user's inputs, ensuring accuracy in the tax claim process.

Once you’ve entered all the required details, the system will automatically calculate and display your total tax offset right next to the Invalid and Invalid Carer Tax Offset field - no manual math needed!

Managing Tax Offset Records

Users have the flexibility to:

- Add multiple records by clicking the Add New record button.

- Edit, delete, or view previously entered records.

- Receive a confirmation popup before deleting a record to prevent accidental removal of important data.

Completing Your Supplementary Tax Return

To ensure accuracy in your claim, follow these steps:

- Calculate Your Tax Offset - Use the ATO Tax Offset Calculator to determine your eligibility and the amount you can claim.

- Review Your Entries - Double-check all the details entered to avoid errors or inconsistencies.

- Submit Your Tax Return - Once all details are correctly entered, proceed with the submission of your tax return, ensuring that all necessary supporting documents are available if required.

For more information and official guidance, feel free to contact us.

FAQs

Q: Who qualifies for the Invalid and Invalid Carer Tax Offset?

A: To qualify, you must provide financial support to a dependent who is either an invalid or an invalid carer. The dependent can be a spouse, parent, child (16 years or older), sibling, or spouse’s sibling. The dependent must also be an Australian resident and have an Adjusted Taxable Income (ATI) below $12,042 in the financial year.

Q: Can I add multiple records for different dependents?

A: Yes, you can add multiple records for different dependents by clicking the "Add New Record" button. You can also edit, delete, or view existing records. A confirmation popup will appear before you delete any record to prevent accidental removal.

Q: What happens if the dependent's Adjusted Taxable Income (ATI) exceeds $12,042?

A: If the dependent’s Adjusted Taxable Income (ATI) exceeds $12,042, the system will indicate that you are ineligible for the Invalid and Invalid Carer Tax Offset. You will not be able to claim the offset for that dependent.