T4 Zone or Overseas Forces Tax Offset

If you live in a remote part of Australia or serve in a designated overseas location as part of the Australian Defence Force or a UN armed force, you may be eligible for this tax offset. It’s designed to provide financial support for those living or serving in challenging conditions.

You may qualify for the Zone Tax Offset if:

- You lived in a designated zone for 183 days or more during the 2023-24 income year, or

- You lived in a zone for 183 days or more between 1 July 2022 and 30 June 2024, including at least one day in 2023-24, and you did not claim the zone offset in your 2023 tax return.

Lived in a zone for less than 183 days in 2023-24?

You might still be eligible if:

- Your stay was part of a continuous period of less than five years starting after 1 July 2018,

- You couldn’t claim the offset in the first year because you stayed less than 183 days, and

- The combined total days in the first year and 2023-24 equal 183 days or more, including 1 July 2023.

This offset helps recognise the extra costs of living in remote areas-so make sure to claim it if you're eligible!

Overseas Forces Tax Offset - Are You Eligible?

You might be able to claim this offset if you:

- Served in a designated overseas location as part of the Australian Defence Force or a United Nations armed force during the 2023-24 financial year,

- And the income you earned wasn’t exempt from tax.

To claim the full offset, you must have:

- Served in the overseas location for 183 days or more during the income year.

Note: Any period where your income was exempt foreign employment income doesn't count towards the 183 days.

This offset helps recognise the unique circumstances of serving overseas-be sure to check if you qualify!

For more details, visit the Australian Taxation Office (ATO) or if you need further assistance, feel free to contact us.

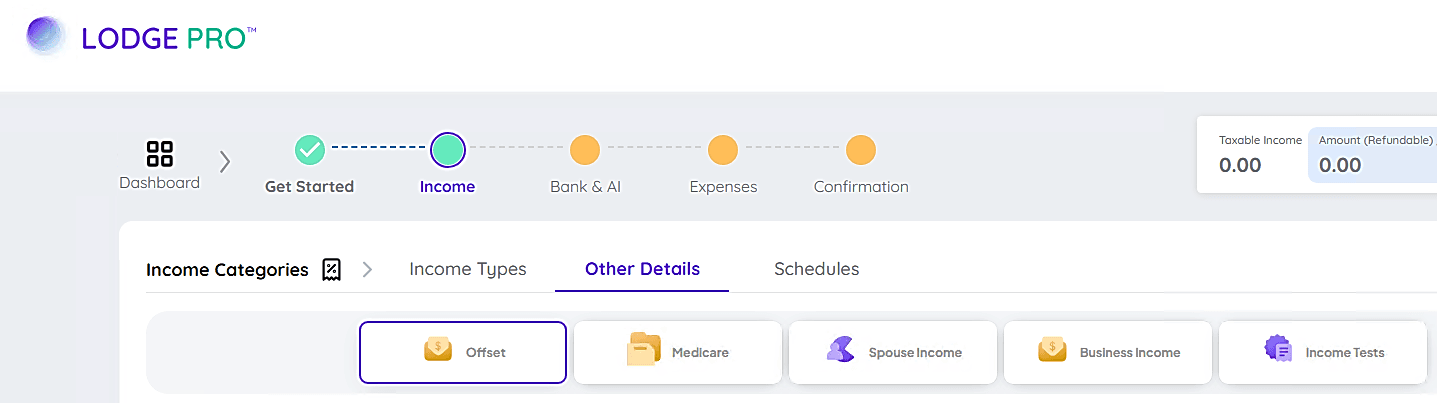

Entering Zone or Overseas Forces Details

To enter the Zone or Overseas Forces tax offset, go to the Income section, then navigate to Other Details, and from there proceed to the Offset section where you’ll find and access Section T4 to input the relevant tax offset information.

Clicking the plus (+) icon to opens the Zone or Overseas Forces screen as a drawer popup.

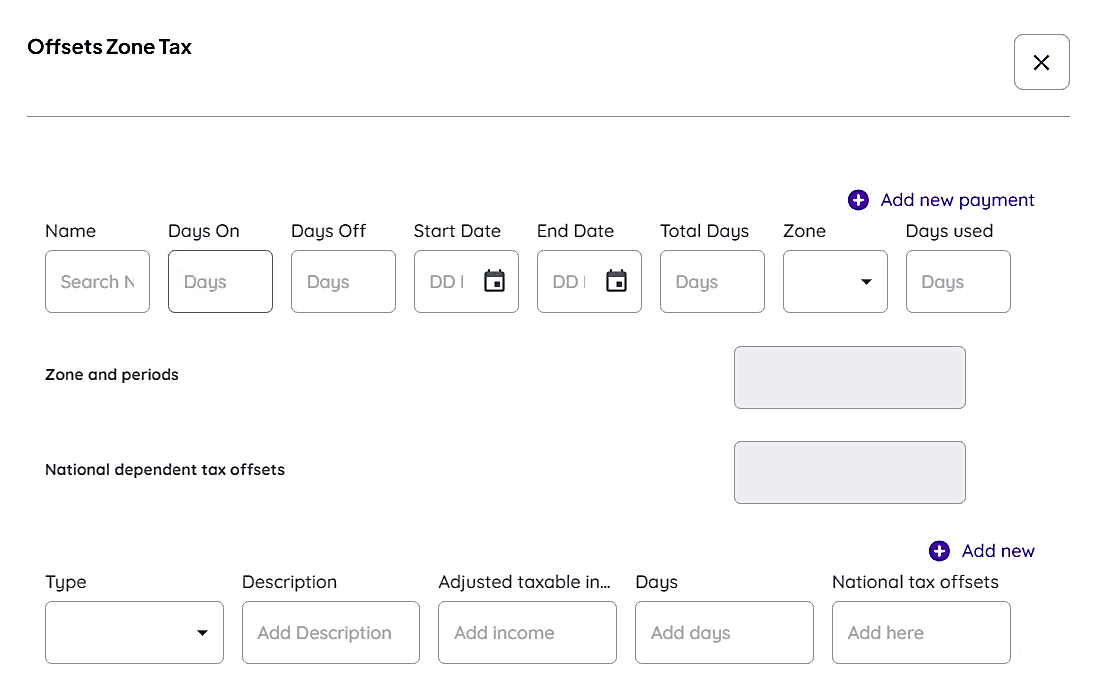

Providing Zone and Period Details

To enter your Zone or Overseas Forces details:

- Enter your name by selecting from a searchable menu.

- Enter the number of days on and off duty in the provided text fields.

- Select your start and end dates using the date picker (format: dd/mm/yyyy).

- Enter the total number of days you served in a zone.

- Select your zone from a dropdown menu.

- Enter the number of days used for the tax offset.

- The system will automatically calculate and display the Total Days Used based on your entries.

You can add multiple records using the Add New button. There are options to edit, delete, or view records as needed. If you attempt to delete a record, a confirmation popup will appear.

Notional Dependent Tax Offsets

To claim a Notional Dependent Tax Offset, provide the following details:

- Select the dependent type from the dropdown menu.

- Enter a description in the text field.

- Enter the adjusted taxable income in the provided field.

- Enter the number of days the offset applies.

- The Notional Tax Offset field is automatically calculated based on your entries.

You can add multiple records using the Add New Payment button. There are options to edit, delete, or view records, and a confirmation popup will appear before deleting a record.

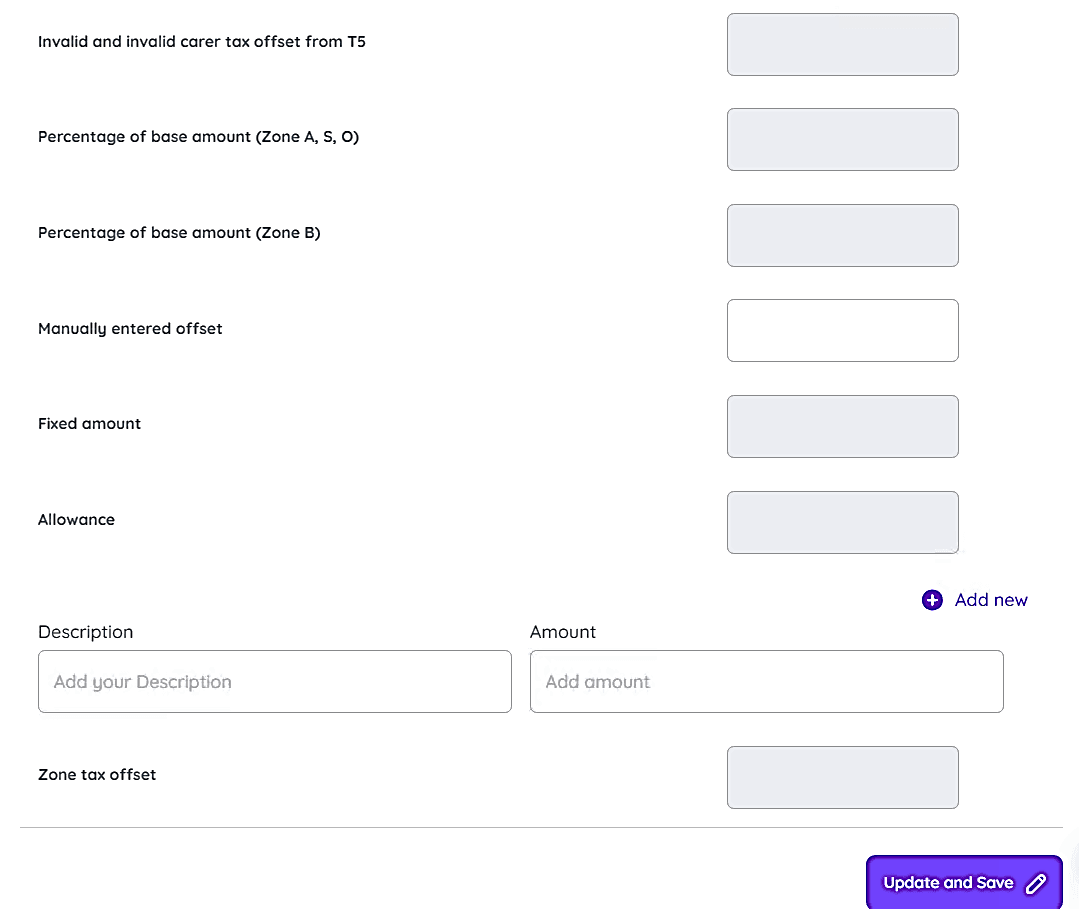

Other Tax Offset Fields

These fields are automatically filled based on other inputs:

- Invalid and Invalid Carer Tax Offset from T5

- Percentage of Base Amount (Zone A, S, O)

- Percentage of Base Amount (Zone B)

- Fixed Amount

You can also manually enter an offset amount in the provided input box. If you need further assistance, feel free to contact us.

Allowance Section

Clicking the plus (+) icon allows you to add records by entering a description and amount. The total allowance amount is displayed next to the field.

You can add multiple records using the Add New Payment button. There are options to edit, delete, or view records, and a confirmation popup will appear before deleting a record.

Zone Tax Offset Calculation

This field is automatically populated based on inputs from other fields.

Completing Your Supplementary Tax Return

Calculate Your Tax Offset using the Zone or Overseas Forces Tax Offset Calculator to determine your entitlement

For more information, feel free to contact us.

FAQs

Q: I lived in a remote area for less than 183 days in 2023-24. Can I still claim the Zone Tax Offset?

A: Yes, possibly! If you’ve lived in the same zone in a continuous period of less than five years since 1 July 2018, and your combined stay (including past years) totals 183 days or more, you may still qualify - as long as at least one day falls within the 2023-24 financial year.

Q: I served in an overseas locality, but my income was tax-exempt. Can I still claim the Overseas Forces Tax Offset?

A: Unfortunately, no. Exempt income from overseas service doesn’t count towards the 183-day requirement for this offset. Only periods where your income was taxable are eligible.

Q: How do I enter Zone or Overseas Forces details on my tax return?

A: To enter Zone or Overseas Forces details, select your name from a searchable menu, input your number of days on and off duty, select your start and end dates, and choose the zone from a dropdown menu. The system will automatically calculate the total days used based on your entries. For any additional support, please don’t hesitate to reach out to us.

Q: What happens if I need to update or delete my Zone or Overseas Forces records after entering them?

A: You can easily edit, delete, or view your records by using the provided options. When deleting a record, the system will display a confirmation popup to ensure the action is intentional.

Q: How do I calculate the Zone Tax Offset if I’ve met all the criteria?

A: You can use the Zone or Overseas Forces Tax Offset Calculator to calculate your entitlement. This tool helps ensure you enter the correct details and calculate your tax offset accurately based on your residence or service in designated zones.