T1 Seniors and Pensioners Tax Offset

Imagine working hard all your life, only to find that retirement comes with its own financial challenges. The Australian Government understands this, which is why they introduced the Seniors and Pensioners Tax Offset (SAPTO)-a special tax break designed to ease the burden for eligible seniors and pensioners.

For many, SAPTO can significantly reduce their tax bill-sometimes even to zero. But how does it work, and who qualifies? Let’s break it down in simple terms.

Who can claim SAPTO?

To qualify for SAPTO, you need to meet both of the following conditions:

1. Eligible for Australian Government Pensions and similar payments

You meet this condition if any of the following apply to you in the 2023-24 income year:

- You received an Australian Government pension or allowance through Centrelink, or you were eligible for a pension, allowance, or benefit from the Department of Veterans’ Affairs (DVA).

- You met the age requirements for the Australian Government age pension in the 2023-24 year but didn’t receive it because you didn’t claim, or didn’t meet the income, assets, or residency requirements.

- You met the veteran pension age test and were eligible for a pension, allowance, or benefit from Veterans’ Affairs, but didn’t claim it or couldn’t receive it due to the income or assets test. This also applies if you are a veteran with eligible war service, a Commonwealth veteran, an allied veteran, or an allied mariner with qualifying service. For more details, refer to the Australian Taxation Office (ATO) guidelines.

2. Meet Rebate Income Thresholds

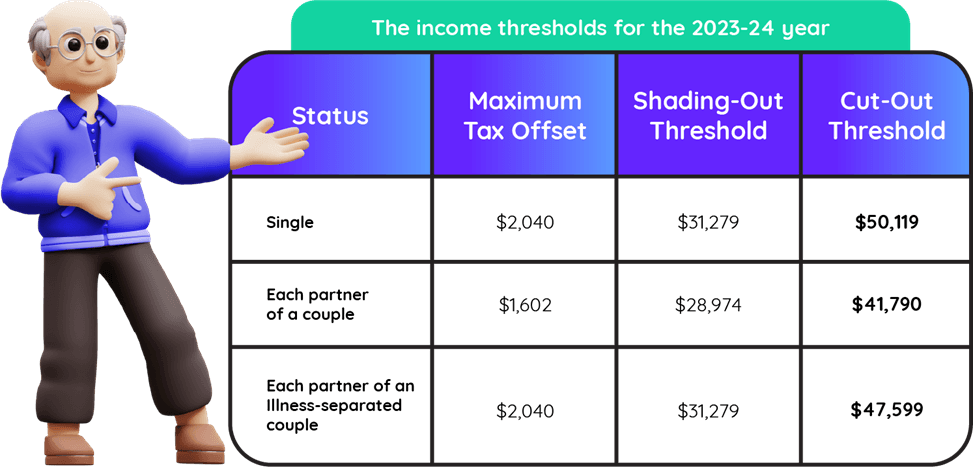

To qualify, your rebate income must meet certain thresholds. Rebate income includes your taxable income, adjusted fringe benefits, and other specific amounts. The income thresholds for the 2023-24 year are as follows:

If your rebate income is below the shading-out threshold, you’ll entitlement for the tax offset. The offset gradually reduces as your income moves between the shading-out and cut-out thresholds.

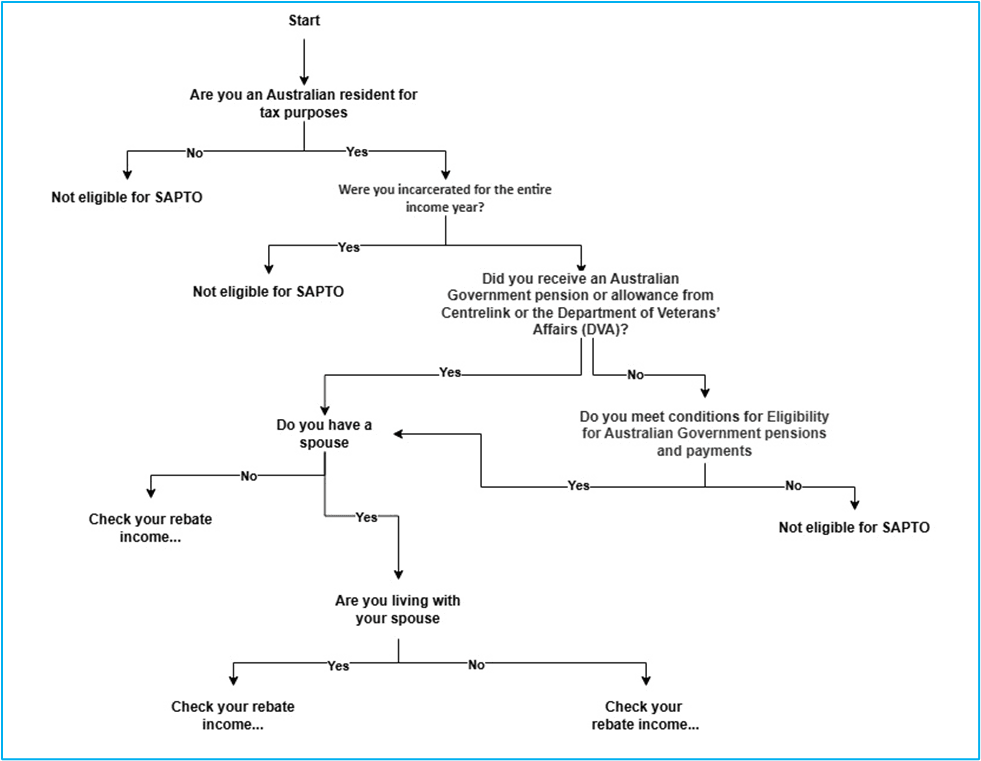

Take a look at the flow diagram below to better understand how SAPTO works!

Claiming the Offset

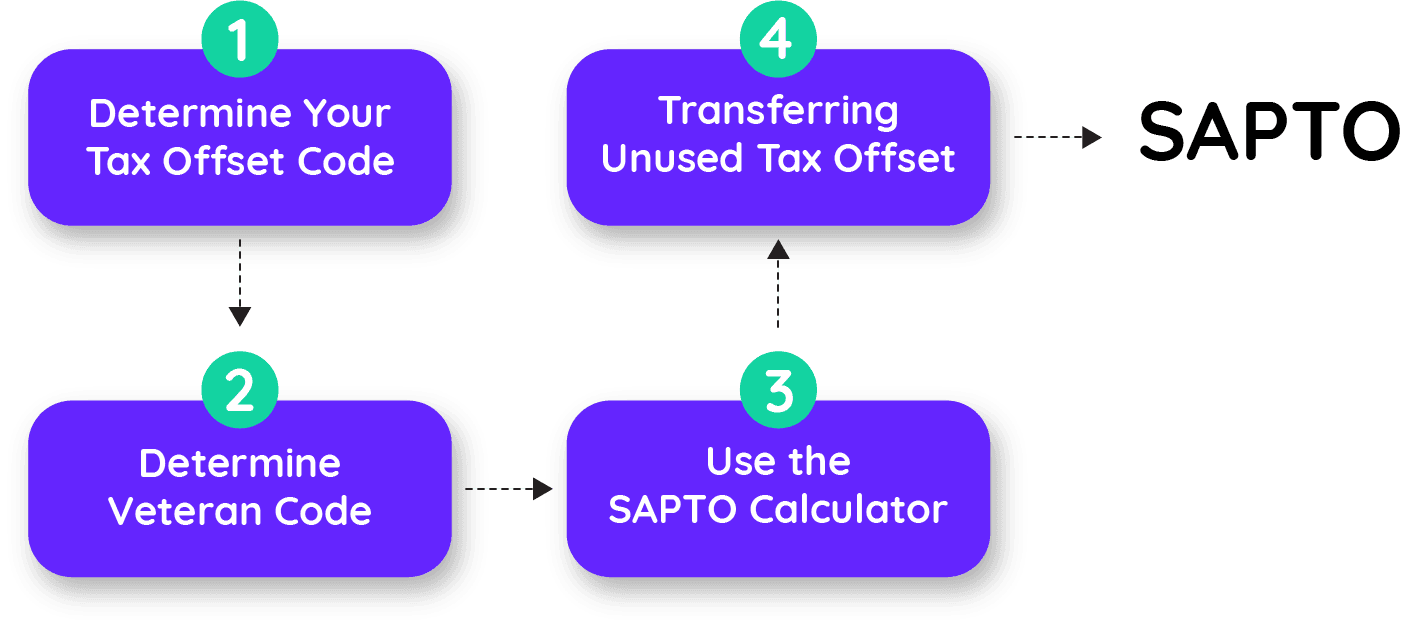

To claim SAPTO, simply follow these steps:

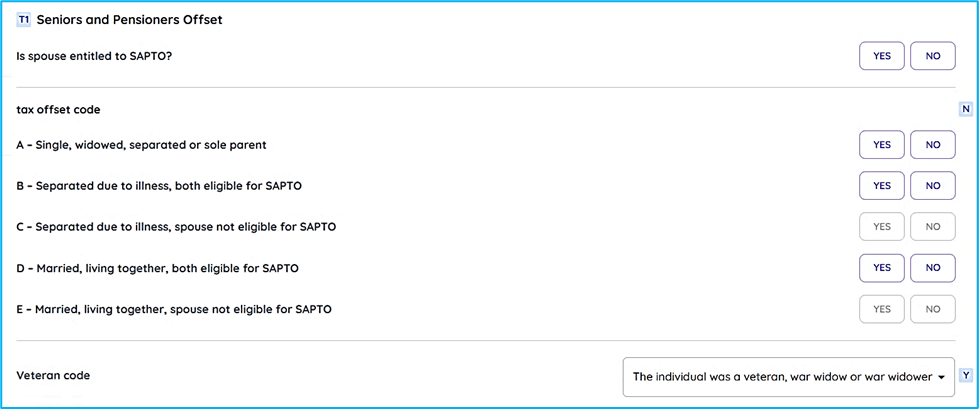

Step 1: Determine Your Tax Offset Code

Choose the letter that best describes your situation:

- A: Single, widowed, separated, or sole parent.

- B: Separated due to illness, both eligible for SAPTO.

- C: Separated due to illness, spouse not eligible for SAPTO.

- D: Married, living together, both eligible for SAPTO.

- E: Married, living together, spouse not eligible for SAPTO.

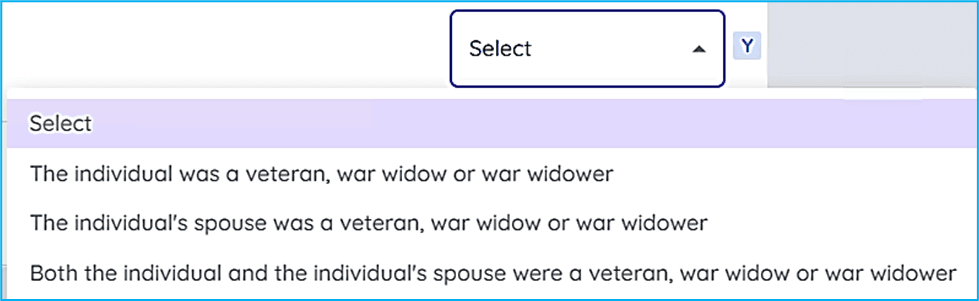

Step 2: Determine Veteran Code (if applicable)

Choose the appropriate veteran code if you or your spouse qualify:

- The individual is a veteran, war widow, or war widower.

- The individual’s spouse is a veteran, war widow, or war widower.

- Both the individual and spouse are veterans, war widows, or war widowers.

Step 3: Use the SAPTO Calculator

To check if you’re eligible and see how much you could claim, try the ATO’s Beneficiary Tax Offset and Seniors and Pensioners Tax Offset Calculator.

Step 4: Transferring Unused Tax Offset

If you and your spouse are eligible, and one of you doesn’t use the full SAPTO entitlement, the unused portion may be transferred to the other, depending on income and eligibility rules.

If you need any assistance, feel free to contact us.

Important Considerations

- Veteran Status: If you or your spouse are veterans, extra rules may apply. Make sure to select the correct veteran code when filling out your tax return.

- Income Tests: Complete all income test questions for the 2023-24 year to ensure your eligibility is assessed correctly.

- Spouse Details: Report your spouse’s income and other relevant details accurately, as this can affect your eligibility and the amount of the offset.

FAQs

Q: What is SAPTO?

A: SAPTO is a tax offset that helps eligible Australian seniors and pensioners pay less income tax.

Q: How do I know if I’m eligible?

A: You’re likely eligible if you receive an Australian Government pension or similar payment and meet the rebate income thresholds.

Q: How is the SAPTO amount calculated?

A: This calculates the offset based on your rebate income and tax return details. You can estimate your offset using the ATO’s SAPTO Calculator.

Q: Can I claim SAPTO if my spouse is not eligible?

A: Yes! You can still claim if you’re eligible. But keep in mind, your spouse’s income and eligibility can affect your tax offset code and how much you receive. For further information please contact us.

Q: Where can I get more help or information?

A: For more information, visit the ATO’s official website, or reach out to us if you need extra help.

Q: Can SAPTO reduce my tax to zero?

A: Yes, SAPTO can reduce your tax liability to zero, but it is a non-refundable offset, meaning you will not receive a refund if the offset exceeds your tax payable.

Q: What if my living situation changes during the year?

A: If your situation changes - like separation, illness, or the passing of your spouse, make sure to update your tax return. This helps ensure you select the right tax offset code.